If you follow Scott Pape, The Barefoot Investor, you’ve probably considered HostPlus Insurance and Superannuation for yourself. HostPlus is an industry superannuation fund with more than 1.2 million members and almost $48 billion in funds under management at 30th June 2020.

The super fund is attractive as it offers a large range of investment opportunities at a low cost to members. HostPlus insurance and superannuation are Scott Pape’s personal choice — but just because it’s the Barefoot Investor Insurance, doesn’t necessarily mean it should be your first choice.

There are a few things to understand before deciding if HostPlus Super Insurance is right for you. HostPlus has two different types of insurance; Fixed or Unitised. There is a big difference between how the premiums and cover are structured under these two different types, and it’s essential you have a solid grasp of both definitions, so you’re able to make an educated decision regarding which one is right for you.

Differences Between Fixed & Unitised Cover

Fixed Cover - is where you choose a cover amount, and that amount stays the same each year — or fixed — while the premiums go up. As you age, you’re statistically more likely to make a claim, and premiums rise in accordance with the increased risk.

Unitised Cover - With unitised cover you pay a set price for each unit of cover you hold. (hostplus.com.au). You will have a certain number of units of cover, each worth a coverage amount corresponding to your age and occupation.

The cost of the units stay the same as you age, but the benefit amount reduces.

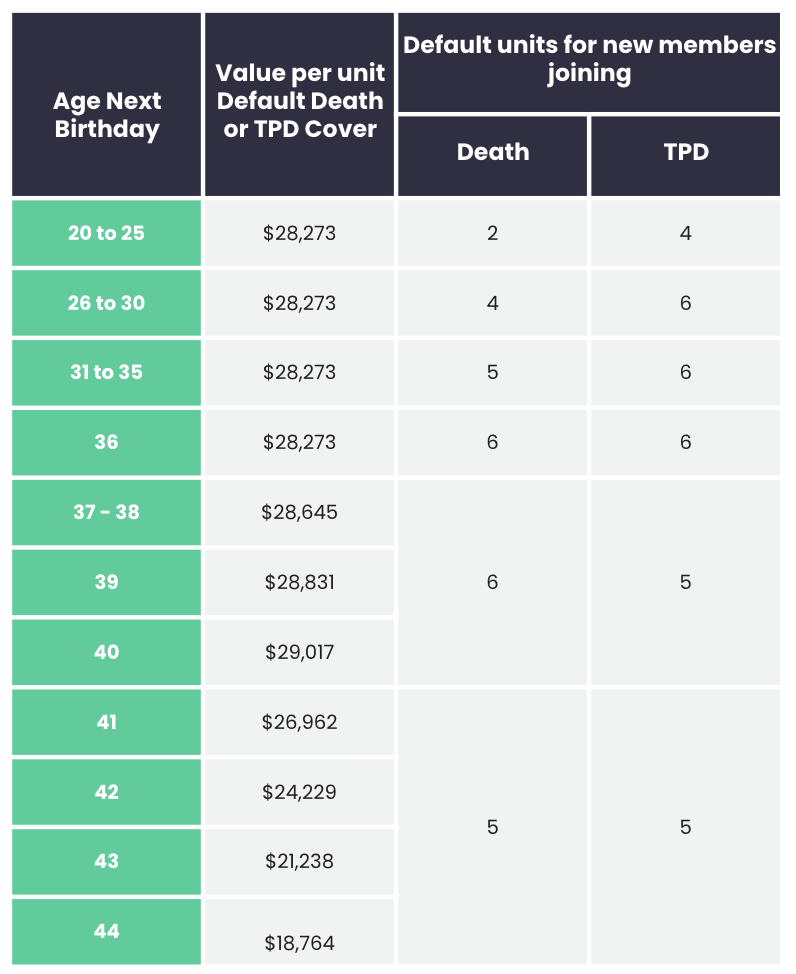

For example, HostPlus offer six units of Death worth $29,017 to someone aged 40 years. When the person turns 41, their unit values will drop to $26,962, but the price per unit remains unchanged. HostPlus has a table included in their PDS that will tell you how much each unit of cover is worth based on your age (see table a).

(table a) - For full table, see HostPlus PDS.

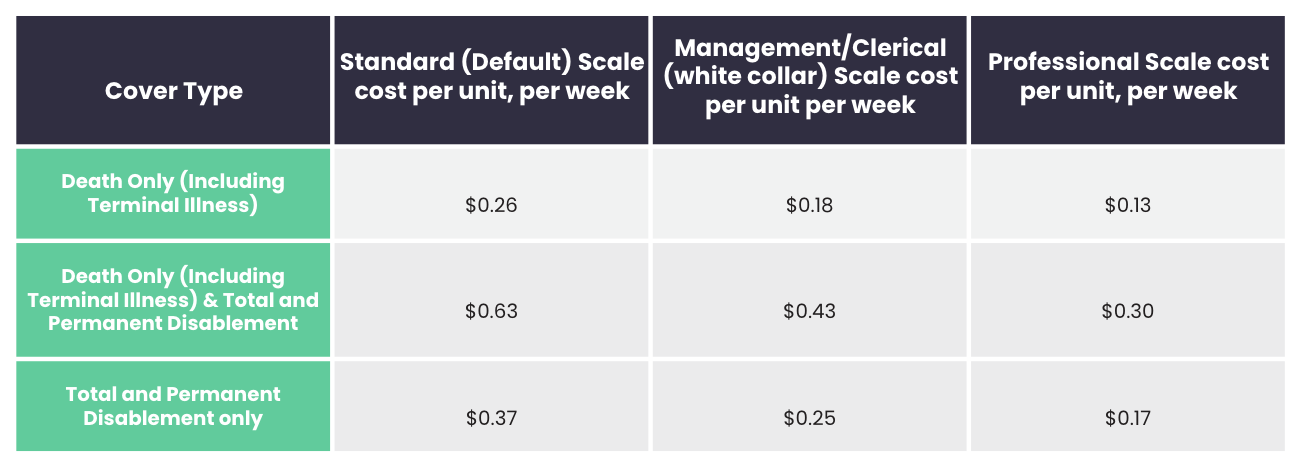

Secondly, they have a table that will tell you how much each unit costs, based on your occupation (see table b). For full table, see HostPlus PDS.

(table b)

Pros and Cons of Fixed Cover

When you choose the fixed option, you can rest assured that your insurance cover amount will always remain at the same value unless you explicitly ask for it to change. For example, if you initially apply for $1 million of cover, your benefit amount will remain at $1 million year after year unless you request for the amount to be changed.

Because the benefit amount stays the same, if it weren’t for the increasing premiums, you could safely set and forget your insurance knowing that you’ll be covered if you were to need to make a claim. But setting and forgetting fixed cover is a very dangerous game.

Your cover level remains fixed, but your premiums increase every year as you age to cover the increased risk of the insurance company; you’re statistically more likely to make a claim, so they need to be compensated for the increased risk. And the amount they increase by really starts ramping up as you move into different age brackets.

Because HostPlus premiums are deducted straight from your super, it’s easy to overlook the cost or be less vigilant than you would be if it were being debited directly from your bank account. If you choose fixed cover and forget to revisit it periodically, you could get a nasty surprise with the premiums as they become increasingly more expensive each year.

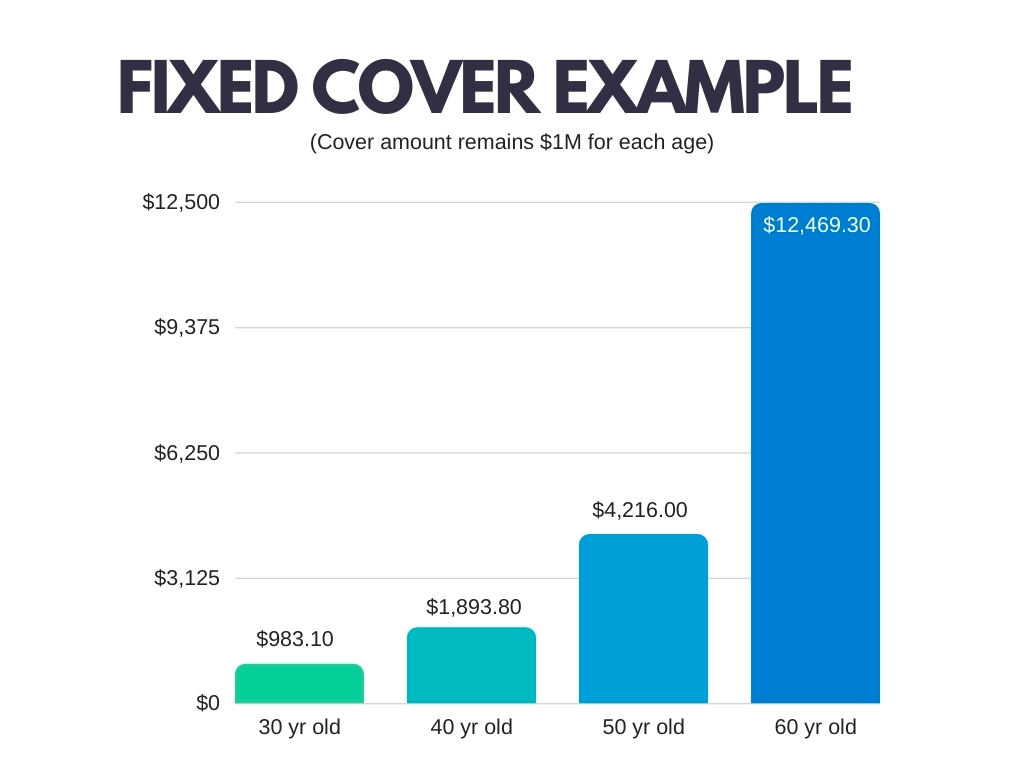

In this example, I’ve run a quote for $1 million of cover for ages 30, 40, 50 and 60. As you can see, the annual premium for age 30 is quite cheap at $983 pa.

At age 40, the premium has almost doubled to $1,893, and at age 50 it’s $4,216 per year. You’d get a very nasty shock if you were to take out insurance at age 30 and not revisit it until age 50. Once you reach age 60, $1 million of cover becomes very expensive at $12,469.

This is because you’re nearing your life expectancy and the chances of the insurer having to pay out on your policy are much higher than the chances of paying out on a policy for a 30-year-old.

If you really, truly needed $1 million of insurance at age 60 then it’s possible you’d be happy to pay such an inflated premium. But if your insurance requirements at age 30 were $1 million then by age 60, they generally would’ve reduced significantly — as is the case with unitised cover!

Pros and Cons of Unitised Cover

Setting and forgetting unitised cover means there is no risk of getting a surprise with the premiums; the premium always stays the same, but the benefit amount of each unit decreases as you age.

There will be no uncertainty with the premiums, but if you leave unitised cover without checking for years, and suddenly need to make a claim, you might find that you have much less insurance than you actually need.

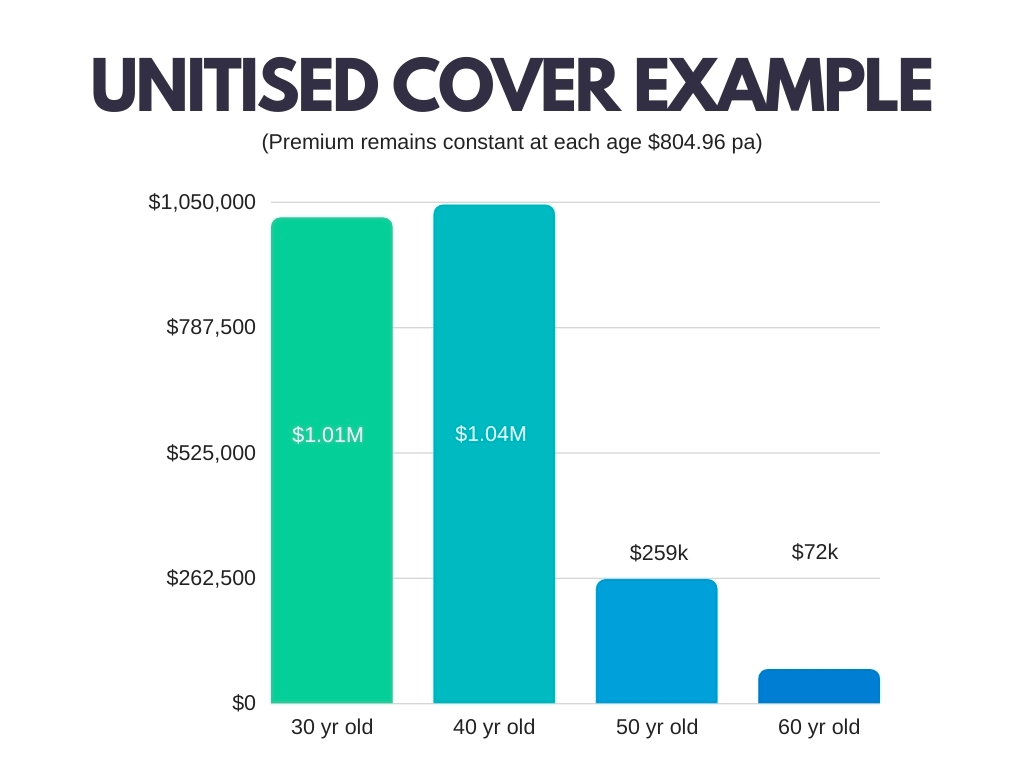

In this unitised cover example for ages 30, 40, 50 and 60, you can see that the premium remains the same at $804, but the cover greatly reduces once you move from your 40’s compared to your 50’s.

As you can see, cover for a 40-year-old is slightly higher than that of a 30-year-old. This is based on their assumptions of what the average person would need in the way of insurance at each age bracket but does not accurately reflect what you as an individual might need.

When you compare the above graph to that of the fixed cover example, the unitised cover would be suitable for the 30 and 40 year age brackets as the benefit amount is approximately $1 million (assuming the required cover amount is $1 million). The cover significantly reduces at 50 years which possibly is not going to be consistent with your insurance needs at 50.

Between 40 and 50 the benefit amount drops by approximately $741,000. This very well could be an appropriate drop-off if you’ve significantly reduced your need for insurance, for example, by paying off your mortgage.

Unitised cover is great for the benefit of keeping a stable premium, but the assumptions used to come up with a cover amount aren’t going to fit everyone’s needs.

Which Option is Right for me?

Before deciding between fixed or unitised cover, you first need to know what your insurance needs are. Figuring out what your needs are is a much more essential step than choosing between fixed or unitised.

I’m not a fan of the multiple of salary method as it focuses on output rather than the needs behind the cover level that’s being suggested. Two people could be the same age and earn the exact same salary with entirely different insurance needs.

One might have a family and a big mortgage they’ll need to cover, while the other person might be single, living in a rental.

There are so many different factors to consider, which is why I believe in four key principles when it comes to insuring yourself and your family:

- Clear the debt on the family home. Your mortgage is probably the biggest and most stressful expense you have. Eliminating that burden for your family would take the pressure off hugely.

- Allow for the surviving parent to become a super parent. In the event of your death, the kids will most likely need some extra support. Insuring yourself for enough to cover a significant portion of your spouse’s wage means that they can be there to solely focus on the kids in the months and years after your death.

- Never have more cover than you need. There’s no point paying a premium for cover that you don’t need — it’s a waste of money. Take off any net investment assets that you have, to reduce the sum insured that you require.

- Have enough money to pay for a funeral and final expenses. Planning a funeral is hard enough without having the added pressure of having to come up with the cash to cover the costs. Allow for this in your insurance so your send-off can be as stress-free as possible.

Let’s take a look at two families at different life stages to give a bit of context regarding your insurance needs.

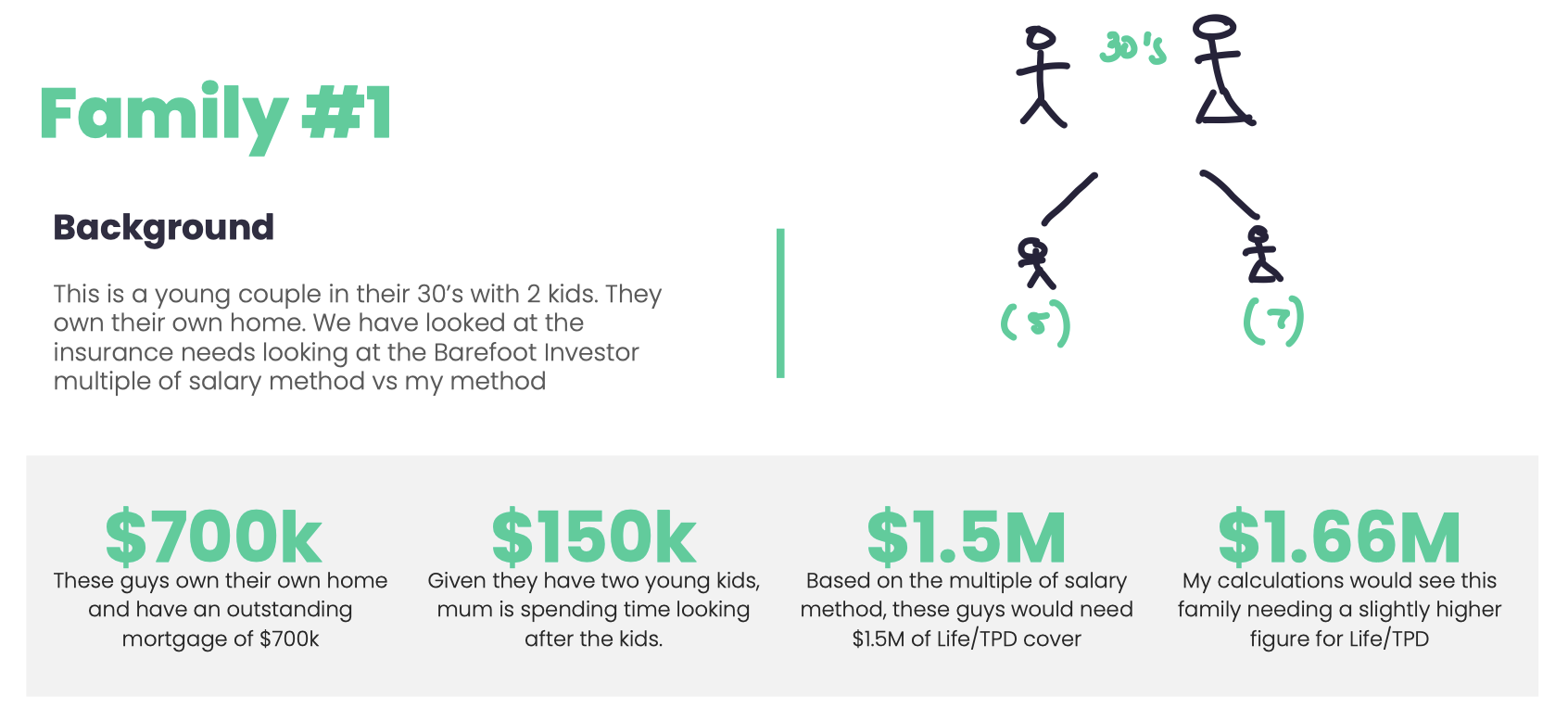

Family #1 are in their 30’s with two kids aged 5 and 7. They have a mortgage of $700,000 with a combined income of $150,000.

Under Scott’s multiple of salary calculation, this family needs $1.5 million. Using my calculations, they need $1.66m

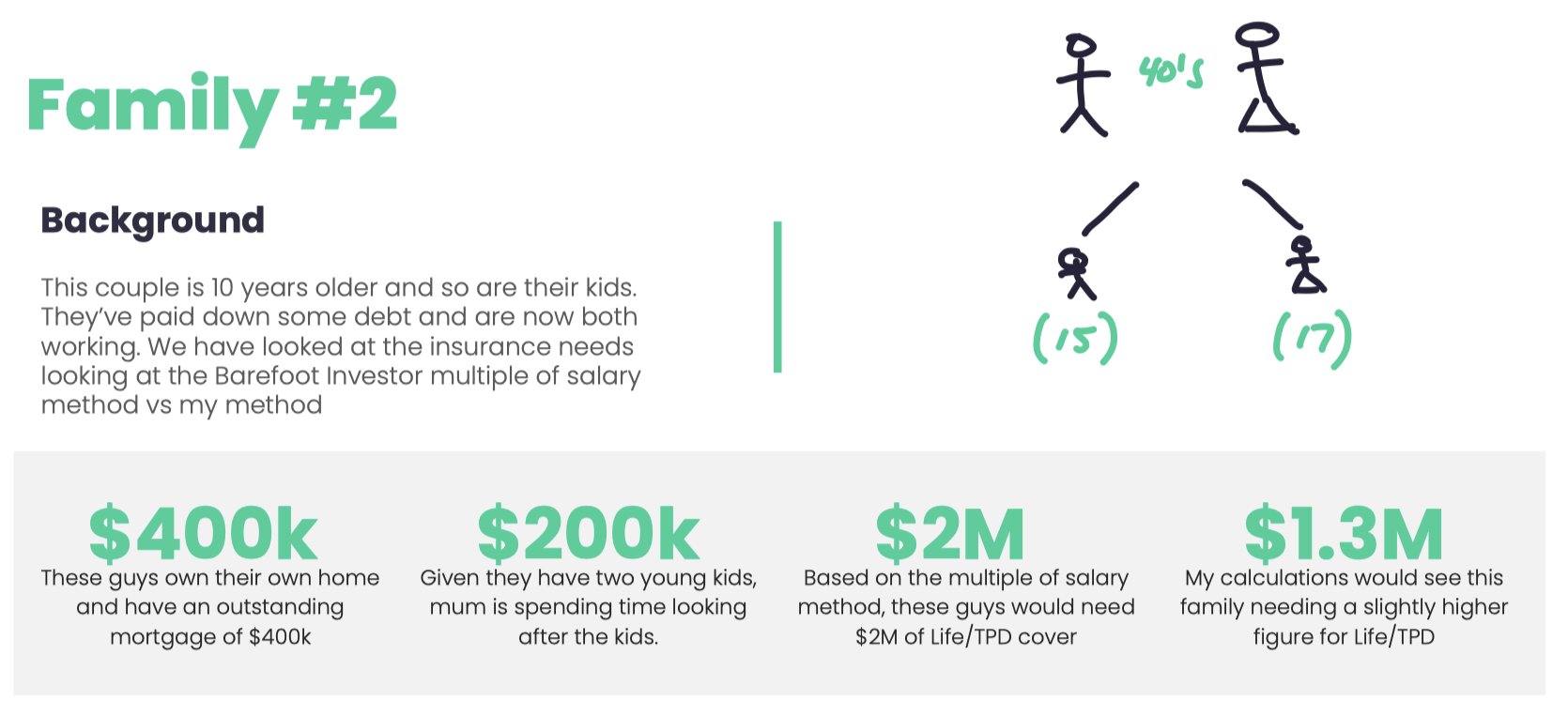

Now let’s look at family #2. They’re ten years older and further along in their lives than family #1. They’re in their 40’s with two kids — 15 and 17. They’ve paid their mortgage down to $400,000 and have a combined income of $200,000.

This family is essentially family #1, ten years down the track. Over ten years, if family #2 had managed to pay down their mortgage by $300,000 and their children were nearing adulthood, does it make sense that they would need more insurance than family #1? No.

They have less of a need because the children won’t require a parent to stay at home and focus on them through their younger years like the 5- and 7-year olds would, and their mortgage has already had a significant amount paid off.

Family #2 doesn’t have a need for more insurance than family #1, which is why my calculations show a need of $1.3 million but Scott’s method suggests $2 million using the multiple of salary calculation. The younger couple needs more than the older couple!

If your need for insurance reduces over time, surely the unitised option would be the ultimate selection, right? Well, no, not necessarily.

Choosing unitised cover means that your benefit amount will be reducing each year, but that might not (and probably won’t) align with your actual insurance needs. Sure, your need reduces, and yes, unitised cover reduces, but essentially the insurance company is dictating how much insurance you need at each point in time. What they say you need isn’t necessarily what you actually need.

Fixed cover offers an element of control. You can insure yourself for exactly what you’ve calculated your needs to be, and you don’t need to worry about that amount reducing each year as you age. This cover does need to be reviewed periodically though because while the cover amount stays fixed, the premiums will continue to rise.

Monitoring your insurance needs and adjusting your cover accordingly lets you ensure you have the right amount of cover at any given time and means you’ll have some level of control over the premium and can monitor them, so they don’t rise without you knowing.

Should I Choose HostPlus Insurance at all?

Now that you’re aware of the differences between unitised and fixed, and the importance of knowing your insurance needs, you’re equipped with the knowledge to choose a policy that’s right for you.

So, how does HostPlus really compare to the market?

Price

When considering the price, you might notice that HostPlus are cheaper than anything else in the market. This is due to a slightly misleading tactic they use. Insurance through super (like HostPlus) receives a 15% tax credit which basically means you get a 15% discount on the premiums.

HostPlus show their premiums after this 15% tax credit has been applied, where the other insurance providers show their quoted premiums before the 15% has been applied. This gives the impression that HostPlus is cheaper, but in reality, you’re not actually comparing apples with apples. Once you take into account the 15% on all insurance, you find that HostPlus isn’t actually the cheapest in the market.

Quality

Okay, so it’s not the cheapest, but how do the features and benefits compare? Let’s just say that when we analysed the same level of cover with the market, we were able to find alternates that provided a much more comprehensive cover for a cheaper price. For more information on this analysis, check out our video.

While HostPlus might be great Barefoot Investor Insurance, it doesn’t mean that it’s right for you.

There’s a lot to know when it comes to the world of superannuation and insurance, so it’s imperative that you take your own, personal needs into account when coming up with a solution. If you need help coming up with answers to any of the topics discussed, feel free to reach out to me via email. I’m always happy to help.

Stop wasting money on premiums!

Download my free guide to avoid the 29 most common mistakes people make with their insurance.

Download Here