The rules for insurance inside of superannuation have changed as of 1st July 2019 due to the Government’s “Protecting Your Superannuation Package” (PYSP) reform. The idea behind the legislation is to protect members with low and inactive funds from having insurance premiums erode their balance. It’s a great initiative in theory — protecting super balances from erosion is important — but there are downsides that need to be considered with these super insurance changes.

How low is too low?

Any account balance under $6,000, or member under the age of 25, cannot have automatic insurance applied. If you fit into this category on 1st November 2019, there’s a chance you may have had your insurance in your super cancelled.

At around the beginning of 2020, super fund providers sent correspondence out to their members detailing the super insurance changes coming into effect. If you didn’t opt in to keep your insurance, it’s definitely worth checking to see what coverage you might (or might not) have in your super fund. Insurance will not be automatically applied for new members under 25 or with less than $6,000. However, it’s still available to them should they wish to have it.

It simply becomes a case of being aware of what cover you need while you’re young or have a low account balance.

Securing insurance cover automatically in your super fund is a way to get around any underwriting requirements. You are not subjected to a medical or any questioning regarding your medical history; cover is simply applied automatically. This has some benefits that may be worthwhile if you want insurance.

Anyone who is either under 25 or have less than $6,000 can let their super fund know, in writing, that they wish to have automatic cover applied. So, it’s not difficult to get insurance for people in this bracket, but they need to know to ask for it. It can be quite handy to get your insurance sorted before age-related ailments hit and make it more difficult and expensive to find cover.

Anyone who doesn’t choose to have insurance while they’re under 25 or have a fund of less than $6,000 can have insurance automatically applied once they’ve reached these milestones.

How Long is too Long?

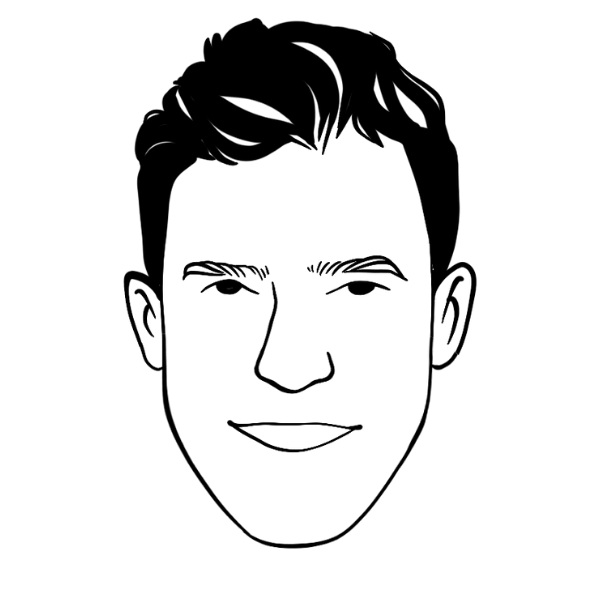

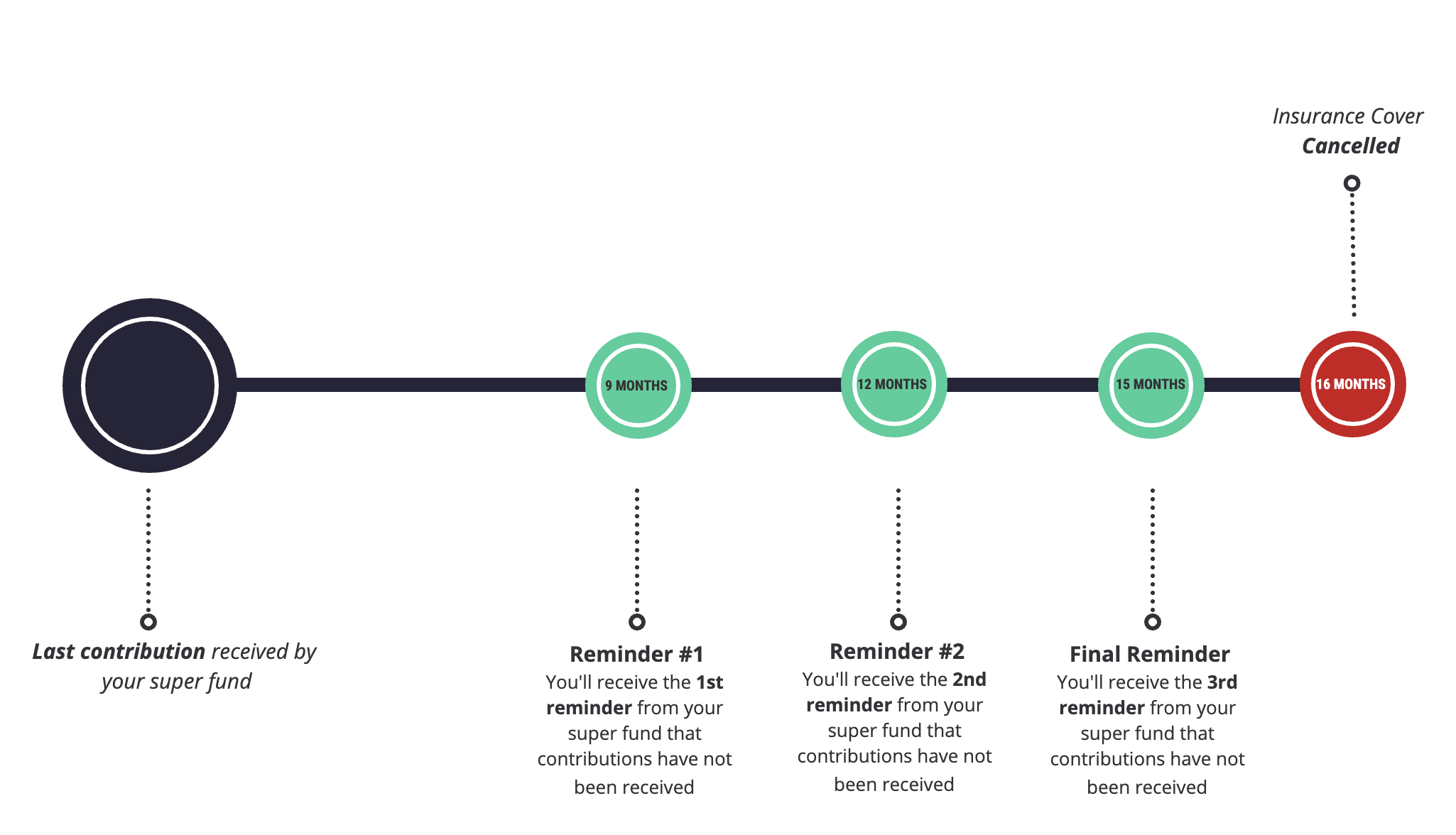

A super fund is deemed to be inactive when there hasn’t been a contribution or rollover for 16 months. Once a fund reaches the 16-month mark, under PYSP, the insurance may be cancelled to prevent the balance from being eaten into by insurance premiums.

Risk to Vulnerable Super Fund Members

PYSP was designed to protect members super fund balances from being eroded by insurance premiums that they may not need nor want. While it’s a good initiative to protect inactive and low balances, it can leave vulnerable members in a risky position.

- A self-employed person who hasn’t been contributing to their fund for a while. If you’re self-employed, then it might be no surprise to learn that making super contributions can sometimes become a low priority. There are many self-employed people who make regular contributions as part of their overall financial plan. Still, there’s also a lot who don’t contribute often enough to keep their fund active. Failing to make a contribution could be for reasons such as low cashflow, investing in alternative platforms or simply just forgetting to do so.

- Mums on maternity leave (or dads on paternity leave). While it’s common for mums to take 12 months off of work once bubs arrives, it’s very easy for those 12 months to turn into 16 months (the time it takes to deem an account inactive) or even longer. Mum might really need her insurance in her super fund but because she’s been busy with one of the most important jobs on the planet — raising kids — she may not have realised that there have been no employer contributions going into her fund. Essentially means the fund has become inactive in her time away from work, leaving her at risk of losing her insurance. And once you’ve got a family to take care of, insurance becomes more important than ever!

A Warning to Members in Vulnerable Positions

This legislation change — while being introduced with the best intentions — actually has the potential to hurt the members it was intended to protect the most. Take and mum and dad, for example. Let’s say dad is self-employed, and mum is currently on maternity leave with another baby on the way.

Dad has been working hard for the past 16 months to provide for his growing family while mum has taken the last 16 months off work to be the primary carer for their child. Mum’s super balance has slipped under the $6,000 mark as it has not received a personal or employer contribution for the entire 16 months.

Dad’s account hasn’t had any contributions made either. Mum and dad have both been too preoccupied with raising a family and haven’t had a chance to even think about their super.

The letter comes regarding the impending cancellation of their insurances. For whatever reason, they disregard the letter and their insurances are cancelled due to mum’s low balance and dad’s inactive account.

Six months later mum has had baby number two and dad is having sleepless nights and is unable to concentrate at work. Dad slips and injures himself doing a job and is now unable to work.

Because mum and dad didn’t notice that their insurance cover had been cancelled, they are now ineligible to make a claim. The breadwinner is out of work, leaving the young family to survive with no income. Well, at least the super fund isn’t being eroded, right? Sure, the super balance isn’t being eroded by insurance premiums. Still, mum and dad are left in an even more vulnerable position with no income and no insurance. Not a good result at all.

Be careful you don’t end up like mum and dad. Know your insurance needs and take action to ensure you are adequately covered. Don’t be caught out thinking you have cover that no longer exists.

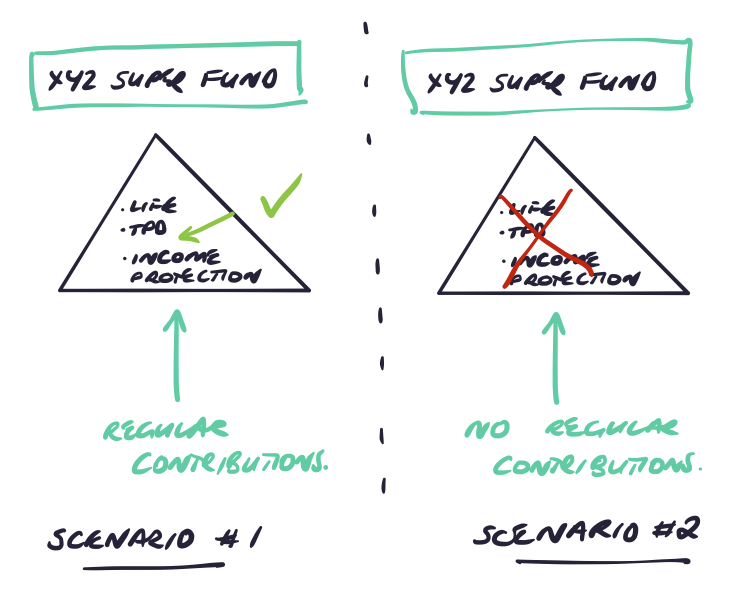

How Can I be Sure I Still Have Insurance Inside Super?

There are a number of ways to check if you have insurance inside of super. You’ll be able to find out how much you’re insured for, what type of cover you hold and how much you’re paying for it.

- Online. You should be able to access your insurance details online with your super account login. There’s generally a section on your super dashboard dedicated entirely to your insurance details.

- Check your statements. Have a look at your super annual statements. If no premiums are being deducted, then that’s a pretty huge indicator that you probably do not have any insurance.

- Call your fund. A very simple way to find out is to call. You’ll need your member number handy, and they’ll ask a couple of questions to verify your identity. Then they’ll tell you everything you need to know.

If you have more than one super account, it might pay to check for insurance policies across all of your funds. You generally can’t claim on multiple policies, so it’s best not to keep policies that are going to prove to be pointless. Keeping your insurances in the one place can save you money and eliminate the risk of paying for a second policy that you wouldn’t be able to claim anyway. Your retirement savings will thank you for it!

How Late is too Late?

Suppose you were under 25 years of age or had an account balance of less than $6,000 as at 1st November 2019. In that case, you should have received a letter informing you of the new legislation. Anyone in this category who didn’t opt in to keep their insurance should have had it automatically cancelled on 1st April 2020. But what happens if you wanted to keep it? If you had your insurance cancelled, there should be an option for you to have it reinstated without having to apply or be subjected to underwriting requirements. It’s definitely worth checking with your super fund, although it could already be too late.

If you’ve just discovered your cover has been cancelled and you’re too late to have it reinstated, don’t stress! It’s an inconvenience, but you may be able to get the same level of cover by applying — you’ll probably be asked to take a trip to visit your doctor though. Inconvenient? Yes. The end of the world? Certainly not.

Vigilance is Needed

If your fund finds its way into low or inactive territory, you will be notified. Generally, you’ll receive reminders at intervals such as 9,12 and 15 months of inactivity before your insurance will be cancelled.

It’s essential to take action if you receive one of these letters. Don’t let your insurance lapse without having an in-depth think about what your insurance needs are. If you no longer need insurance, take a moment to think about if you’ll need it in the future, because it will be much harder — and possibly more expensive — to apply for insurance further down the track.

- Suppose you are self-employed or taking a break from work and aren't having any contributions made. In that case, you run the risk of having your insurance cancelled. If you would like to keep your cover, you could set up an automated contribution to be made from your bank account periodically to ensure your account does not become inactive. This amount could be as low as you’d like. Even just contributing $1 every 15 months would be enough to keep your account active — although it may not be enough to keep your balance growing. Depending on your returns and the cost of your premiums, you may need to add a little more from time to time to ensure your balance is not declining.

- Suppose your super balance is at risk of falling under $6,000. In that case, you could schedule an ongoing contribution to be made from your bank account to cover the cost of the insurance premiums. The insurance is held and paid by your super fund, but you’re effectively covering the cost from your own bank account to ensure the premiums aren’t eroding For more information regarding the tax side of this strategy see Income Protection and Tax Time.

Alternatively, you could choose to forgo insurance inside of your super and decide to hold a policy outside of superannuation. There are pros and cons to each scenario; it really comes down to what’s right for you and your financial goals for yourself and your family.

Don’t Ignore Your Insurance! (or your super)

Regardless of whether you need insurance or not, you need to know what your insurance needs are. Once you’ve established what the right amount of cover for you is, you can go about checking if you’re adequately covered.

To get you started, here are some questions to ask your super fund regarding your insurance:

- Do I have insurance inside of super?

- What sort of cover do I have?

- How much am I covered for?

- How much are the premiums?

- Do I have regular contributions going into my super?

- What is the balance of my super?

Asking these questions will allow you to find out if you still have insurance in your super fund. With these answers, you’ll know if you’re at risk of it being cancelled in the future from a low balance or inactive funds.

In Summary

You manage what you monitor. As long as you remember to be vigilant and aware of what’s going on with your insurance and your super funds, you have the ability to manage your cover. The super insurance changes from The Putting Members’ Interests First reform were rolled out with the best intentions, and it will save a lot of people unnecessary costs. Still, it also has the potential to be detrimental to vulnerable members.

All you need to do is be aware of this fact and double-check what cover you have in place — it may just save you from becoming like mum and dad in the earlier example.

Stop wasting money on premiums!

Download my free guide to avoid the 29 most common mistakes people make with their insurance.

Download Here