You work hard for your income. It’s essential for your lifestyle and livelihood, so it makes sense to take out income protection insurance to cover you in the event that you are unable to work due to illness. Come tax time, there’s another way to protect your income — reducing your expenses by claiming a tax deduction.

But not all income protection policies are created equally and so, your eligibility to claim a deduction depends on the structure of your policy.

What is Income Protection?

Income Protection is an insurance policy that covers the majority of your income for a specified period of time if you are unable to work due to illness or injury. While the definition remains the same across policies, there are differences regarding the terms of the policies such as the waiting periods, exclusions, claim eligibility criteria, and different structures (to hold the policy inside or outside of super). Whether you can claim a tax deduction for your premiums basically comes down to the structure of your policy.

Insurance Tax Deduction for Income Protection Inside of Super (Owned and paid by your superannuation fund)

Holding an income protection policy inside of super can be a great way to access affordable insurance that doesn’t have an impact on your day-to-day cash flow.

Policies inside of super generally don’t have the bells and whistles available that policies outside of super can offer. However, it can still suit many individuals who are seeking a cost-effective, basic income protection policy.

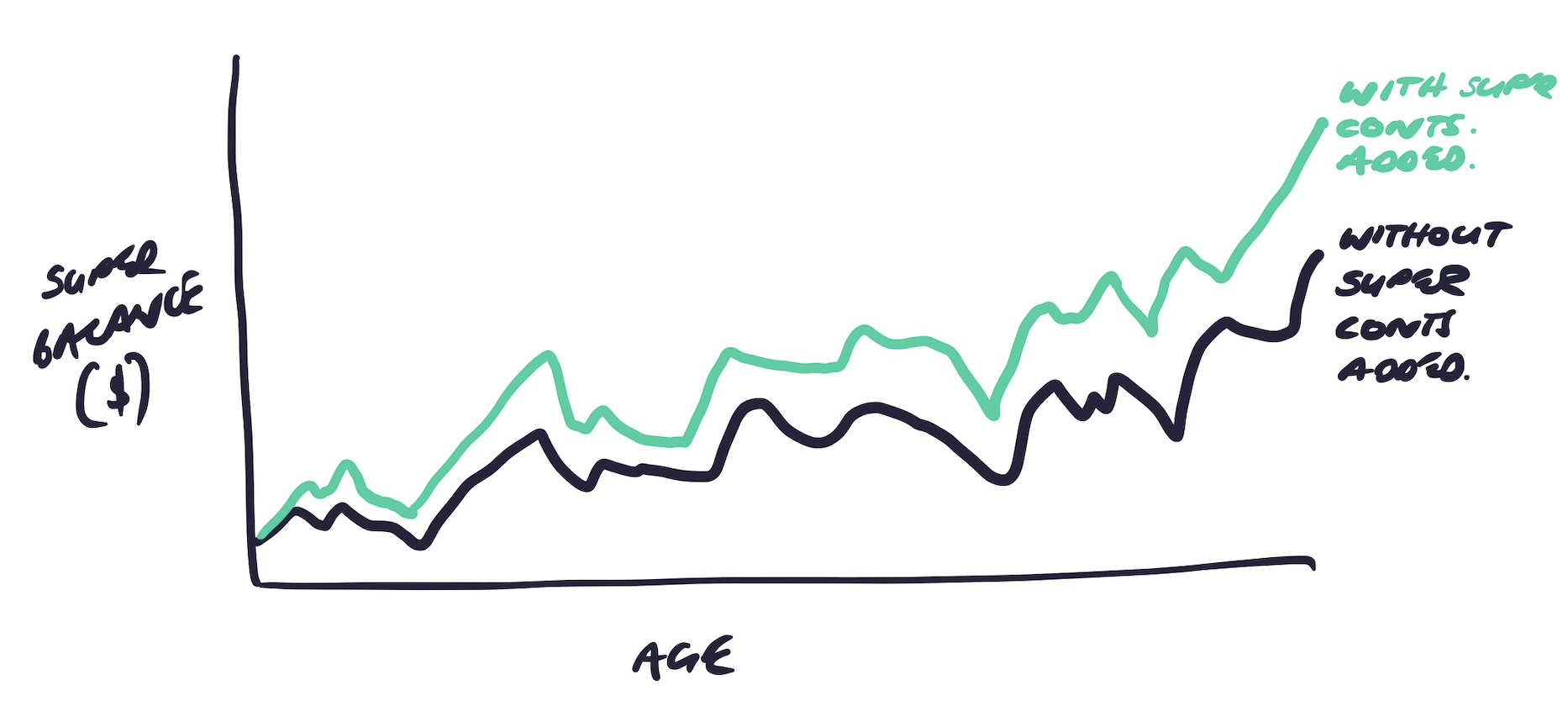

The thing to watch out for regarding the payment of premiums is your long-term wealth.

Because the premiums are being paid from the super fund, the fund balance will be eroded over time. In 30 years, your super balance could be significantly less than what it could’ve been, had the policy been held outside of super.

Please have a look at our Income Protection Guide for more info regarding this.

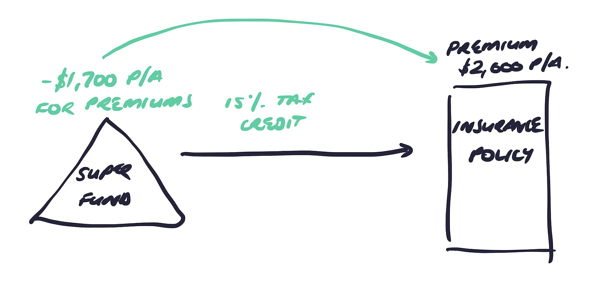

Premiums paid by your super fund are not tax-deductible and cannot be claimed in your personal tax return. But this doesn’t mean they are without any tax benefits.

Tax-effective ways to pay for your insurance inside of super could be to make a personal contribution for the amount of the premiums. A deduction can then be claimed on this personal contribution. A salary sacrifice arrangement could be established to cover the cost of the premiums using pre-tax salary — which means you pay the super tax rate rather than your marginal tax rate, and your super balance isn’t being eroded by the premiums.

While you are unable to claim a personal tax deduction on your premiums through super, the super fund will claim the premiums as an expense which ultimately reduces the tax payable by the fund.

It’s important to discuss tax strategies with a trusted professional before jumping in as there are a lot of things that need to be taken into consideration when assessing your individual needs. There are both pros and cons to holding insurance inside of super so if the structure is right for you, remember that claiming a tax deduction isn’t everything. You are reaping benefits in other ways.

Insurance Tax Deduction for Income Protection Outside of Super (paid from your bank account)

Holding a policy outside of your super fund generally means you have the advantage of added features and flexibility over policies held inside a superannuation fund.

One of the standout features of holding a policy outside of super is being able to choose between indemnity value or agreed value cover.

Under indemnity value cover, your benefit amount will be paid out according to what you are earning over a period of time prior to the claim.

Under agreed value cover, the benefit amount is set at the inception of the policy — even if your income amount reduces, you’ll still be eligible for the agreed value.

Whilst the agreed value is no longer available for new clients (check out this article for more information on the changes), existing clients with these policies will be able to retain this structure.

When it comes to deductions, the Australian Taxation Office (ATO) allows you to claim a tax deduction for your premiums paid from your bank account. That is personal policies that you hold outside of your super fund.

When it comes to claiming a tax deduction for insurance premiums, only premiums of policies designed to replace income can be claimed.

Insurance Tax Deduction for Trauma Insurance Outside of Super (paid from your bank account)

Trauma or Critical Illness policies provide a lump sum benefit should you suffer a critical illness or serious injury.

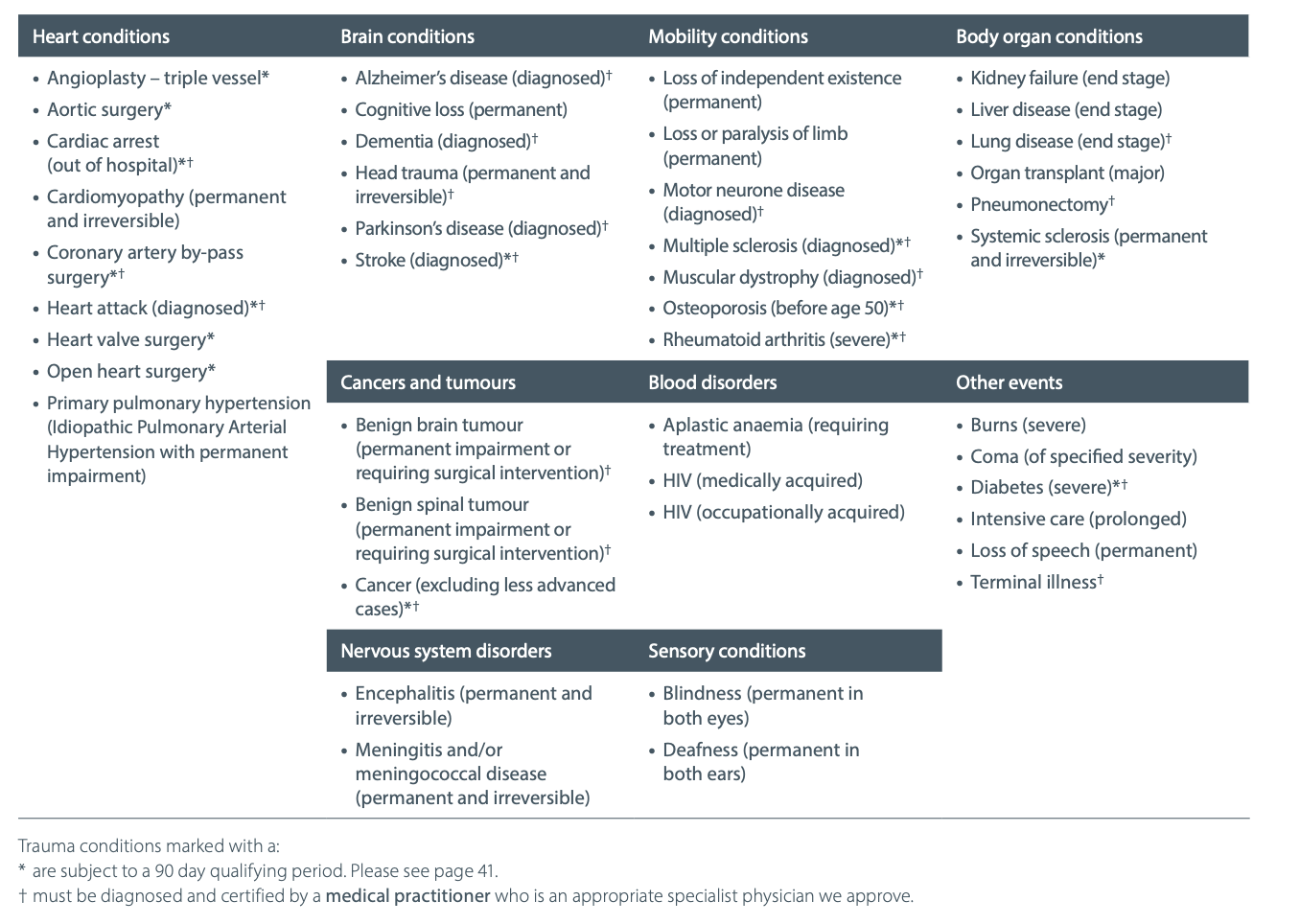

While each insurance provider differs regarding medical definitions and the range of illnesses they cover, generally speaking, they’ll cover cancer, heart conditions such as heart attack and angina, stroke, and major injuries.

They do not cover mental illness. To gain a full understanding of exactly what is covered under a Trauma policy, it is important to always read the Product Disclosure Statement (PDS) an example is provided below (source OnePath PDS 1 April 2020).

While Income Protection premiums paid from your bank account are tax-deductible, Trauma premiums are not. This is because the lump sum benefit paid out upon making a claim is not taxable income — and this is a very good thing! Imagine having to pay tax on a lump sum payout of say $300,000. Tax would eat right into that lump sum amount!

While no tax deduction can be claimed on Trauma premiums, it is still a very worthwhile policy to hold for a lot of individuals. Tax deductions are certainly not the be-all and end-all when it comes to insurance policies; there are countless other benefits — namely the lump sum benefit to be used for medical and living expenses in the unfortunate event of becoming critically ill or seriously injured.

Claiming Income Protection Tax Deductions

If you personally hold an income protection policy, your insurance provider will send you a tax statement each year.

The tax statements are sent out shortly after the end of the financial year.

It is important to wait for this tax statement to avoid making any errors with your tax. The statement shows how much has been paid out in benefits if you’ve made a claim during the financial year, and also shows how much you’ve paid in premiums in order to claim your income protection tax deductions.

The tax statement will show you how much you are able to claim as an income protection tax deduction and it’s as simple as entering this amount under the Other Deductions category as a work tax deduction.

Conclusion

It’s always a great feeling when you have something you can claim a tax deduction for. After all, your hard-earned cash is better off in your pocket than the tax man’s.

It’s essential that you don’t place too much importance on maximising your deductions when deciding on an insurance structure that suits you. Yes, it’s great to be able to claim your premiums as a deduction, but creating the perfect insurance strategy to meet your individual needs can be much more beneficial to your overall financial goals in the long run.

If you’d like to discuss your insurance needs and how they impact your overall financial goals, I’m always happy to help, and I’d love to hear from you.

Stop wasting money on premiums!

Download my free guide to avoid the 29 most common mistakes people make with their insurance.

Download Here