Trauma Insurance and Income Protection are two different types of insurance that provide financial protection for the unexpected.

Trauma Insurance provides a lump sum payment that can compensate for medical bills, lost wages, rehabilitation costs, and other expenses related to the diagnosis of one of the listed conditions on these policies.

Income Protection provides replacement income in the event you become unable to work due to injury or illness and will continue until you can return to your job.

These two forms of protection offer many benefits however there are some differences between them that we need to take into consideration before making a decision about which one may be best suited for you!

1. What is Trauma Insurance (aka Critical Illness Insurance)?

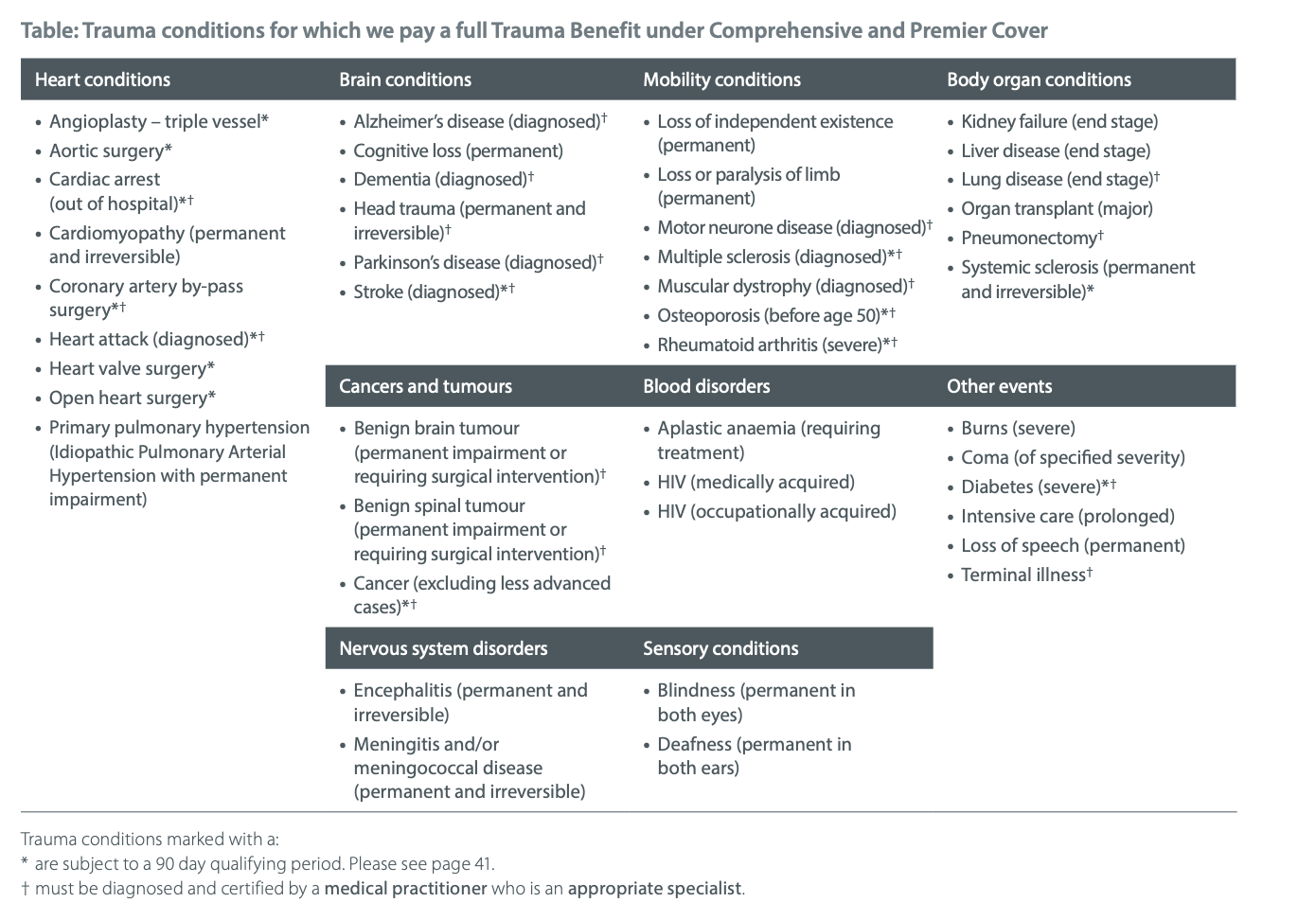

Trauma insurance, also known as critical illness, pays a lump-sum payment upon diagnosis of one of the listed conditions within the policy.

With most companies, there are 40+ listed conditions that are covered however the majority of claims come from the following:

- Cancer

- Heart attack

- Stroke

Here is an example of some of the other conditions covered under a standard Trauma Insurance Policy

The trauma cover benefit is paid in one lump sum to you the policyholder and can be used for any purpose you decide on, whether that's paying off debt, paying for any medical expenses, or anything else (think rehab expenses or care).

Trauma insurance is not considered a replacement for health insurance and in most cases, it does not cover any pre-existing conditions you may have before the policy would start.

Another reason to consider trauma cover even if you have Private Health Insurance is due to the gap payments that are payable.

If you have ever needed to claim on your Private Health Insurance, you would be familiar with the Medicare Fee, the Scheduled Fee, and what the Specialist charge. The difference in these amounts is known as gap payments.

These gap payment can add up and is a reason to consider Trauma Insurance even if you have Private Health insurance.

NB - this also assumes that you are able to be treated here in Australia.

2. What is Income Protection

Income Protection is designed to provide you with a monthly income for the duration of your recovery.

The policy pays out as long as you are unable to work or earn an income due to injury or illness. The easiest way to think about this is that you will continue to receive benefits from this policy as long as you hold a medical certificate stating that you can't work.

Some of the key terms regarding an income protection policy are:

- Monthly Benefit - this is the amount you are paid monthly whilst you are on claim

- Waiting period - this is how long you have to wait before claiming benefits i.e. the time you are unable to work

- Benefit Period - This is how long you will continue to be paid should you continue to be unable to work.

For more information on Income Protection, you may want to check out my complete guide here.

Income Protection Insurance falls into two categories: being inside or outside of your superannuation.

It is a good idea to check with your existing superannuation fund to see whether you have Income Protection in place at the moment.

Income protection insurance is tax-deductible and the benefits are taxable.

3. When should I buy Trauma Insurance vs. Income Protection

In order to decide whether you need Trauma Insurance or Income Protection, it's important to first consider your own financial situation or needs.

Trauma insurance ensures that you can still cover basic needs even if your ability to work has been impacted by trauma. It's important for everyone, but a question worth asking would be whether or not you have access to an emergency fund at the ready should you need it in a hurry.

Some of the options as alternates for Trauma Insurance cover are:

- A savings account - if you have savings set aside that you could use to help fund any medical expenses then you may not need to have Trauma Insurance in addition to this.

- Most people I talk to in this position obtain some quotes to see how much the Trauma Insurance would cost before making a decision≥

- An investment portfolio - (whether this be shares or property) that you would be willing to sell and use to fund any additional cost associated with the

- Family support - if you are in a position where your family could step in and help financially should anything happen to you, then maybe Trauma Insurance is not required.

In my opinion, income protection is important to consider if you and your family are in a position that you would struggle to cover your regular expenses should the income stop.

For some couples, both partners in the relationship will have this policy. For others, it will be just one partner's coverage who usually makes more money.

4. How much does it cost to purchase Trauma Insurance or Income Protection Insurance?

Life insurers use a number of factors to determine the price of both Trauma Insurance and Income Protection.

- Age

- Sex

- Pastimes

- Health

- Family History

All of these have an impact on the cost of Trauma Insurance or Income Protection.

You can find out more about what influences these prices by checking this link:

There are some additional things that impact the price of Income Protection:

- Occupation

- Income

- Waiting Period (how quickly do you need these payments to start) - the shorter the waiting period, the more expensive the cover

- Benefit Period (how long you need to benefits to be paid should you claim) - the longer the benefit period, the more expensive the cover.

5. How Much Trauma or Income Protection Do I Need?

When assessing how much insurance you need it is important to consider your own financial situation or needs.

It’s important to mention that a Trauma Insurance policy can be the most expensive type of insurance, so it’s important to make sure that this fits within your budget.

As a rule of thumb, I generally suggest you consider two parts when considering the cover amount:

- Medical treatment/expenses - this is an amount of money you have insured to cover medical costs

- Time - this portion of the cover allows you to take into account your budget and buy as much flexibility as you can afford

The idea of Trauma Insurance is to provide you with peace of mind but be careful to make sure this is sustainable and works with your budget.

The maximum amount that you can have with Income Protection is 75% of your pre-disability income.

Unlike Trauma Insurance, it can sometimes be difficult to replace income protection with money. The reason for this is having enough assets to provide passive income (income from your investments) greater than what you earn from work takes time.

This can be done but is less likely than some of the alternate options that are available to replace the lump sum payment needs of Trauma Insurance

6. Where can I find a quote for Trauma Insurance or Income Protection?

There are many ways to find quotes & learn about Trauma Insurance policies and Income Protection.

Unlike Income Protection, you cannot hold Trauma Insurance inside your super fund, which means that you will not be able to get quotes for Trauma Insurance by contacting your existing super fund.

To get a claim for a Trauma Insurance Policy, here are a few options:

- Online quoting tools such as Lifebroker (NB this is owned by the insurance company TAL)

- Going to a direct insurer such as Noble Oak

- Or alternatively, by contacting a financial adviser

7. Is there anything else I need to know about buying either of these types of insurance policies?

Insurance is complicated and there will always be some factors that you need to think about before buying.

These are just a few points for you to consider. If you wanted to see a more detailed breakdown of the differences between Trauma Insurance and Income Protection, check out this video (also at top of the article) where I have outlined 13 key differences between these two insurance policies.

Conclusion

Insurance is a confusing topic and one that many people don't have the time to research. This article has hopefully helped you understand some of the differences between Trauma Insurance and Income Protection.

If you're still not sure if either or both are right for you, reach out to us! We'll do our best to help answer your questions and point in the direction of what would be most beneficial for your situation.

And remember - we've got an awesome free insurance calculator that can tell you how much coverage might cost based on different factors like age, income level, etc., so take advantage!

Stop wasting money on premiums!

Download my free guide to avoid the 29 most common mistakes people make with their insurance.

Download Here