You know that you need insurance, but what type should you get?

There are many types of insurance to choose from and it can be overwhelming.

This article will break down trauma insurance so that you can make an educated decision about whether or not this is the right type of coverage for your needs.

What is trauma insurance and why do you need it?

Trauma Insurance (otherwise known as Critical Illness Insurance or Recovery Insurance) provides you with a lump sum amount should you be diagnosed with one of the conditions listed on your policy.

Typical illnesses that are covered by trauma insurance policies include cancer, heart attack, and stroke.

What this means is you will receive a one-time lump sum payment for your policy regardless of the severity or duration of your illness (e.g., whether it's terminal).

This type of coverage protects against out-of-pocket costs such as prescription medication, gap payments to physicians' office visits (the difference between the Medicare Fee, Scheduled Fee and what the Dr charges) and ambulance rides on top of what traditional insurance covers while also providing additional financial security in case something has happened to you or someone close to you.

Whilst you may have accumulated wealth in property or shares, you may struggle to put your hands on a lump sum of cash in a hurry should this be required unexpectedly.

Having the peace of mind that the financial side of things is taken care of allows you to focus on recovery knowing that there will be no impact from a financial perspective on you or your family.

What is covered by Trauma Insurance?

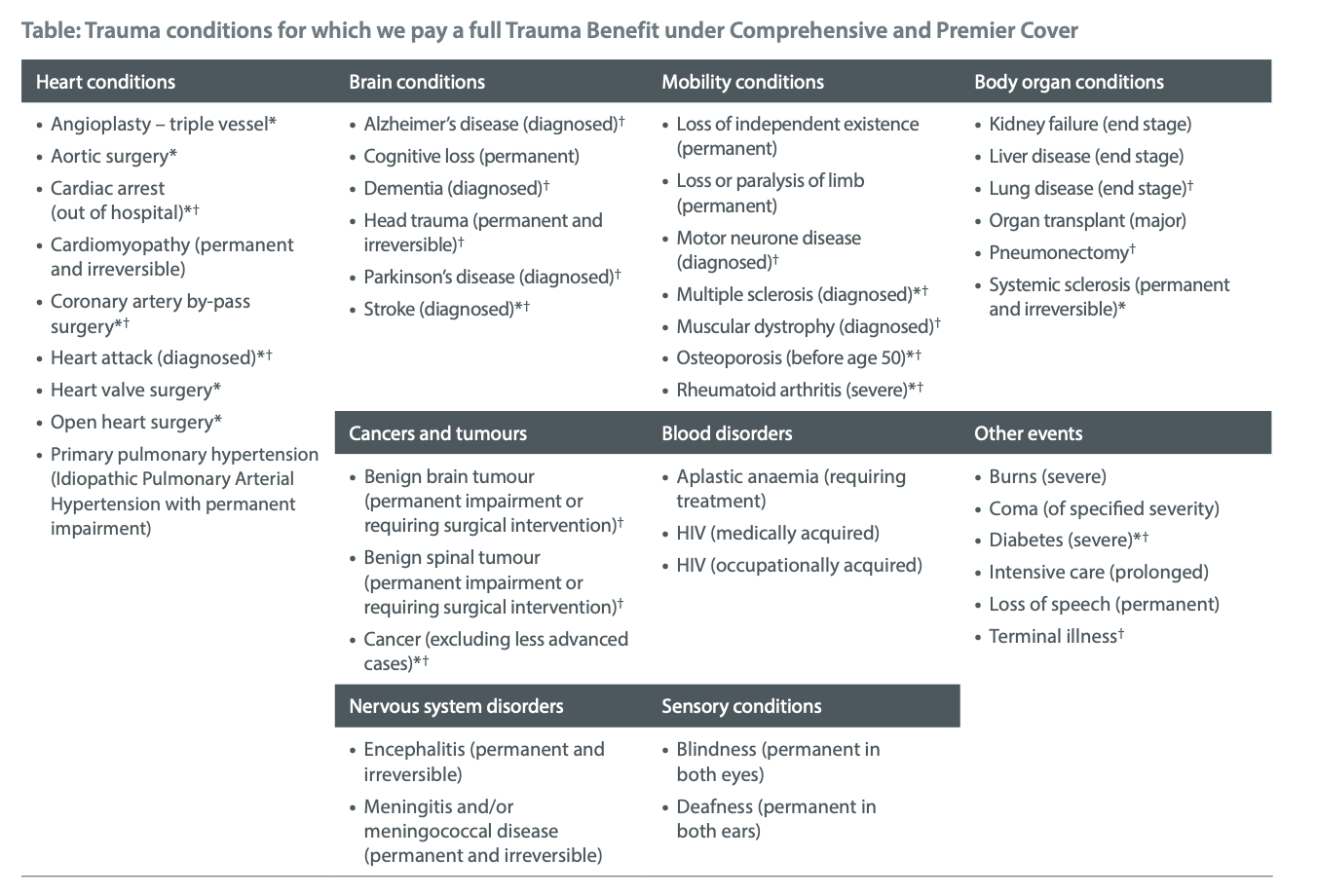

Each of the life insurers has variations to the conditions and definitions contained in their trauma cover however there is generally a range of conditions covered (around 40).

The majority of Trauma Insurance claims come from a heart attack, cancer, and stroke.

Below is a summary of a product disclosure statement from an insurer outlining the trauma events covered as an example of a typical policy:

Each insurer will have slightly different definitions for each of these underlying conditions (ie what they classify to be heart conditions or heart disease, brain tumor, head trauma, cancer etc).

If you need some help deciphering this information, you could do some research online by reading each of these product disclosure statements or seeking some help from an adviser (like us 😉).

How much Trauma coverage is needed?

As with all insurance cover types, it is important to consider your objectives & financial situation when determining the cover amount you should have.

I believe that Trauma Insurance should be purchased for two main reasons:

- To help cover any medical expenses and treatment

- To buy you as much time as possible to recover

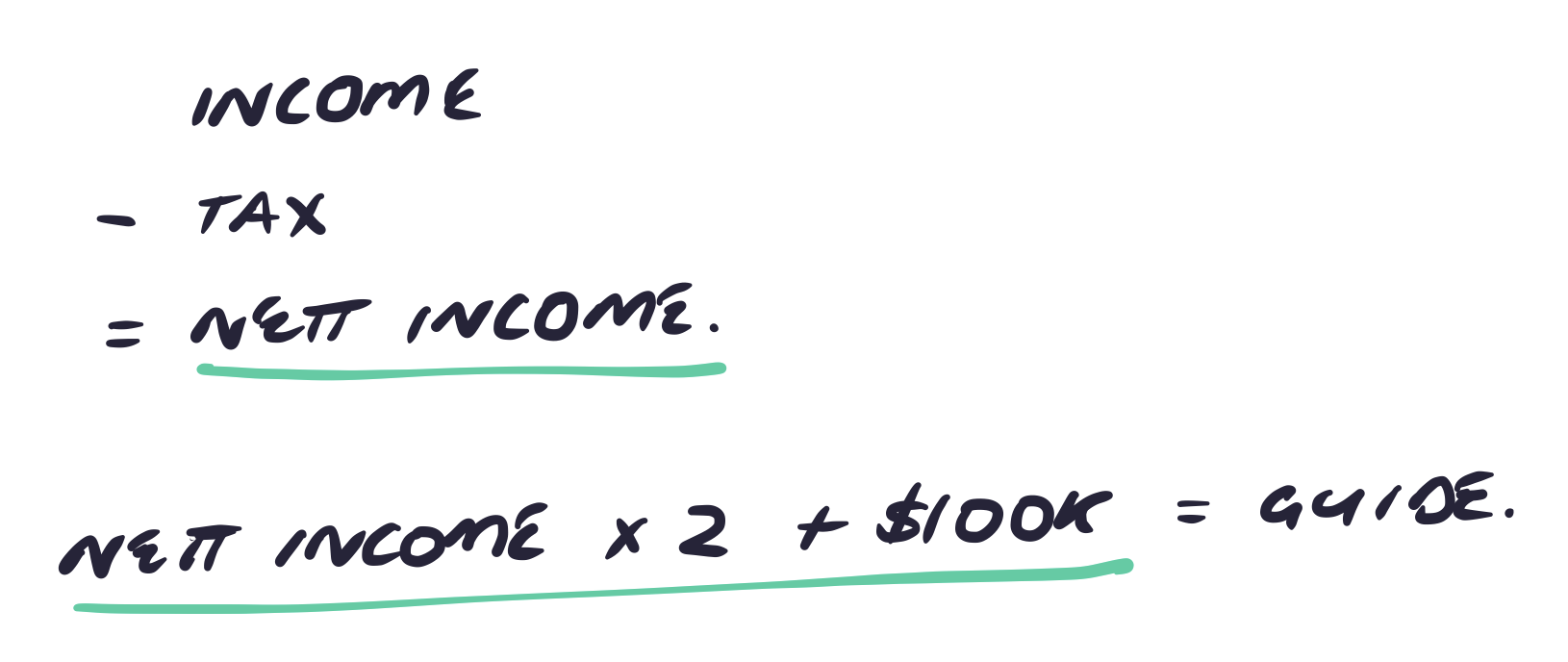

As a guide to working out how much Trauma Insurance you should have, I use a principle based on the following equation:

Trauma Insurance required = 2 years nett income + $100,000.

As a rule of thumb, I generally suggest a minimum of $250,000 as a starting point.

How much does Trauma Insurance cost?

The cost of trauma is based on a number of factors, but the most important is your age and occupation. As such, it can be difficult to provide an accurate figure for you without knowing more about your circumstances.

What I will say here though is that Trauma Insurance should not be viewed as something that only high-net-worth individuals need - in reality, anyone with any assets needs some level of cover due to unforeseen events like accidents or illness

Trauma Insurance is one of the more common claims. As such, the price for this cover is more expensive as it is more likely than some of the other insurances that you will hold.

As premiums for Trauma Insurance need to be paid from cash flow (rather than from your super account) we are generally more mindful of how much we can allocate to spend on this type of cover.

Get some quotes and look at how much cover you can afford based on your financial situation or needs and work backward from there.

Who should have trauma insurance

Trauma Insurance is not just for the rich. In fact, it is often the case that you can reduce the amount of trauma insurance you have as you build wealth (as long as you are prepared for the consequences of an accident or illness)

Another thing to consider when determining if you should have Trauma Insurance is whether you have any family support (financial) that you could access if required.

Generally, I suggest getting some pricing to see how much this will cost before making a decision.

Do I need Trauma Insurance if I Have Life Insurance?

Firstly, I think it is important to understand the major differences between Trauma Insurance and Life Insurance.

I believe it is best to consider the purpose of these covers which will help you make this decision.

Life Insurance cover = designed to provide an amount of money to other people (think family and loved ones) to reduce the financial impact of you passing away. Most people consider important factors such as debt levels, age of kids etc when determining how much life insurance is required.

A Life Insurance policy requires you to die or become terminally ill to benefit from this life cover therefore this cover is "selfless"

Trauma Insurance cover = designed to assist you financially if you are diagnosed with one of the listed conditions on your policy. This payment is generally used to assist with medical expenses and provide you further assistance providing choice and flexibility to do whatever it takes to get better.

Trauma Insurance cover is therefore a more "selfish" type of insurance as you will personally benefit from this policy.

What is the difference between TPD Insurance and Trauma Insurance?

The major differences between Trauma Insurance and TPD insurance are that trauma insurance provides you with cover in the event of diagnosis of one of the listed conditions irrespective of whether this stops you from working or not.

TPD insurance on the other hand does not have any specific conditions listed in their policy however requires you to have suffered from an injury or illness that precludes you from ever working again.

Both provide a lump sum payment so it is worth looking at both types of policies before making your decision on which policy will be best for you and your family.

Insurance companies can not legally provide advice but we recommend getting professional financial advice from a qualified adviser whose business specialises in this area.

Can Trauma Insurance be held within super?

In the past, it was possible for Self Managed Super Funds to purchase Trauma Insurance for the members of the fund.

If you have had a Trauma Insurance policy in place for a while, it is possible to you could have a Trauma Insurance policy with your SMSF however this is unlikely.

It is not possible to purchase a new Trauma Insurance policy within your super fund and all premiums for Trauma Insurance must be paid from your personal cash flow (bank account or credit card).

The reason for this is to do with the condition of release rules that apply to accessing funds from the superannuation environment.

Do I need Trauma Insurance if I have Private Health Insurance?

Some of the benefits of Private Health Insurance are:

- More control over your health care. With private health insurance, you can choose your own doctor and hospital from those who participate with your fund without having to worry about astronomical fees.

- No waiting in queues for treatment.

- More money back on other health services (such as dental and optical)

- Pay less tax (by avoiding the Medicare Levy surcharge depending on your income)

- Enjoy greater peace of mind.

As you would have discovered Trauma Insurance pays a lump sum should you be diagnosed with one of the listed conditions on the policy, for example, heart attack, cancer, or stroke.

Even if you have private health insurance, if you need to seek medical treatment there are often additional out-of-pocket expenses above the Medicare Fee, the Scheduled fee, and what the Dr. actually charges.

In addition to this, the financial flexibility that Trauma Insurance provides is something that is very different to Private Health Insurance

Conclusion

With all the different types of insurance to choose from, it can be overwhelming.

This article breaks down trauma insurance so you have more information about whether or not this is right for your needs and will help you make a decision on which type of coverage best suits your lifestyle.

Have you ever wondered what the difference between critical illness & income protection insurance was?

Check out our video that explains the differences between these two coverages!

Stop wasting money on premiums!

Download my free guide to avoid the 29 most common mistakes people make with their insurance.

Download Here