Are you wondering if it makes more sense to have your personal insurance in super or outside of super?

This is a question that many Australians are facing, so we’ve put together some information about the pros and cons of both options.

What is Superannuation?

Superannuation is designed as a tax-effective way to save for retirement.

In addition to being a tax-effective way to fund your retirement, superannuation also provides a variety of other benefits. For example, the allowance to have insurance as part of your super fund.

Keep in mind that the purpose of a super fund is to provide for your retirement. Insurance benefits, while helpful, are not the entire focus of your funds which is why the Superannuation Legislation (SIS) puts limitations on the quality and payout arrangements of covers.

Let’s have a look at how this works.

Types of insurance policies can you have in super?

There are 3 types of policies that can be included in super:

1. Life Insurance Cover

As the name suggests, a life insurance policy covers you if you die. This can be a great policy to have in place so that your family and loved ones receive some much-needed financial assistance should anything happen to you.

Also included in most life insurance policies is a Terminal Illness Benefit. Generally, this benefit will payout in the event you are diagnosed with a terminal illness. The criteria for receiving a benefit is that you are given a prognosis that you have less than 12 or 24 months to live depending on your policy.

The reason I mention this is that in my experience, we have had assisted with a number of Terminal Illness claims and it is often not commonly understood.

2. Total and Permanent Disablement (TPD) Insurance

This policy covers you if you become totally & permanently disabled (as the name suggests). This typically requires two Dr's to confirm that it unlikely that you will ever be able to return to work again.

NB - there are some limitations to the type of TPD insurance policy that can be owned and paid for through super. Only "Any" Occupation TPD policies can be owned and paid for via super whereas "Own" Occupation TPD must have at least a portion of the policy owned and paid for from outside of super to meet the legislative rules. If you need advice on the difference between to two and which would be best for you check with your adviser.

3. Income Protection Insurance

This covers you if you are unable to work for an extended period of time (longer than your waiting period) due to illness or injury.

An Income Protection policy pays you a percentage of your income (generally up to 75%) each month and is designed to help make up for some of the lost earnings and expenses when you are not able to work due to injury or illness.

For more information about Income Protection check out this article which a complete guide to Income Protection Insurance.

NB - Most superannuation funds will offer some insurance in super with automatic acceptance for life insurance, TPD insurance cover, and Income Protection Benefits. Check your super fund's product disclosure statement for more details

What types of insurance policies are not allowed within super?

Trauma insurance or critical illness cover does not meet SIS legislation, therefore, cannot be put in superannuation. There are some exemptions to this rule if you have very old policies that were put in place before the new legislation was brought in.

What are the Pros of insurance in super?

- Generally lower premiums, especially if you are eligible for group coverage through your industry fund (although this is changing rapidly as many industry funds have raised their premiums over the past year).

- Good for your cashflow/budget management

- Often fewer health checks required/cover is given by default

- Tax effective due to super environment

What are the Cons of insurance in super?

- Lower quality policies in order to meet SIS legislation (eg: any occupation on TPD, basic Income Protection definitions)

- Premiums reduce your super balance (retirement savings) over time (unless you offset this with extra contributions)

- Life cover potentially taxable in the event of a claim (if left to non-dependents as defined by the ATO), TPD taxed at up to 21.5% if a claim is made under preservation age

- A 3rd party involved – the contract is now between you, the insurer, and the super fund trustee. This can increase complexity at claim time.

- Cover may not be guaranteed (this is especially true for industry and retail funds. SMSF cover is usually guaranteed). This means the policy terms can be changed at any time, usually not in your favour.

- The requirement to be "Gainfully Employed" for Income Protection policies. This means you need to be working at the time you suffer your injury or illness (not always the case eg redundancy or maternity leave).

How does having insurance premiums paid from super work?

If insurance is applied for with super fund directly:

In this scenario, you have your super with XYZ Superannuation Fund.

You realize that you need insurance so you contact XYZ Superannuation Fund and ask them for some quotes and apply for your insurance with them. The premiums for this insurance will be deducted from your balance with XYZ Superannuation Fund.

If insurance is applied for externally (ie through an adviser/broker):

With the help of an adviser or broker, you can apply for retail insurance policies with any of the big insurance companies in the market and have this owned through the superannuation environment.

You have the ability to then nominate where the premiums for these policies are paid from.

Using the above example, you can apply for insurance with ABC Insurance Company and nominate that the premiums are paid from XYZ Superannuation Fund.

Should I have my insurance inside or outside of super?

To answer this question you must consider your own personal circumstances and needs – after all, there is no one size fits all approach to this or "right answer".

One of the benefits of getting advice from a financial adviser is that they should be able to show you a number of options and then let you decide which is the best option for you.

Your adviser should be able to understand your personal objectives and provide personal financial advice that suits these needs that will not only assist you to answer this question about ownership but also how to make sure you have the right amounts of cover to protect yourself and your family.

Insurance can be complex so it may be worth getting some professional advice before making any final decisions (even though you might think I am biased on this).

Insurance can be complex so it may be worth getting some professional advice before making any final decisions (even though you might think I am biased on this).

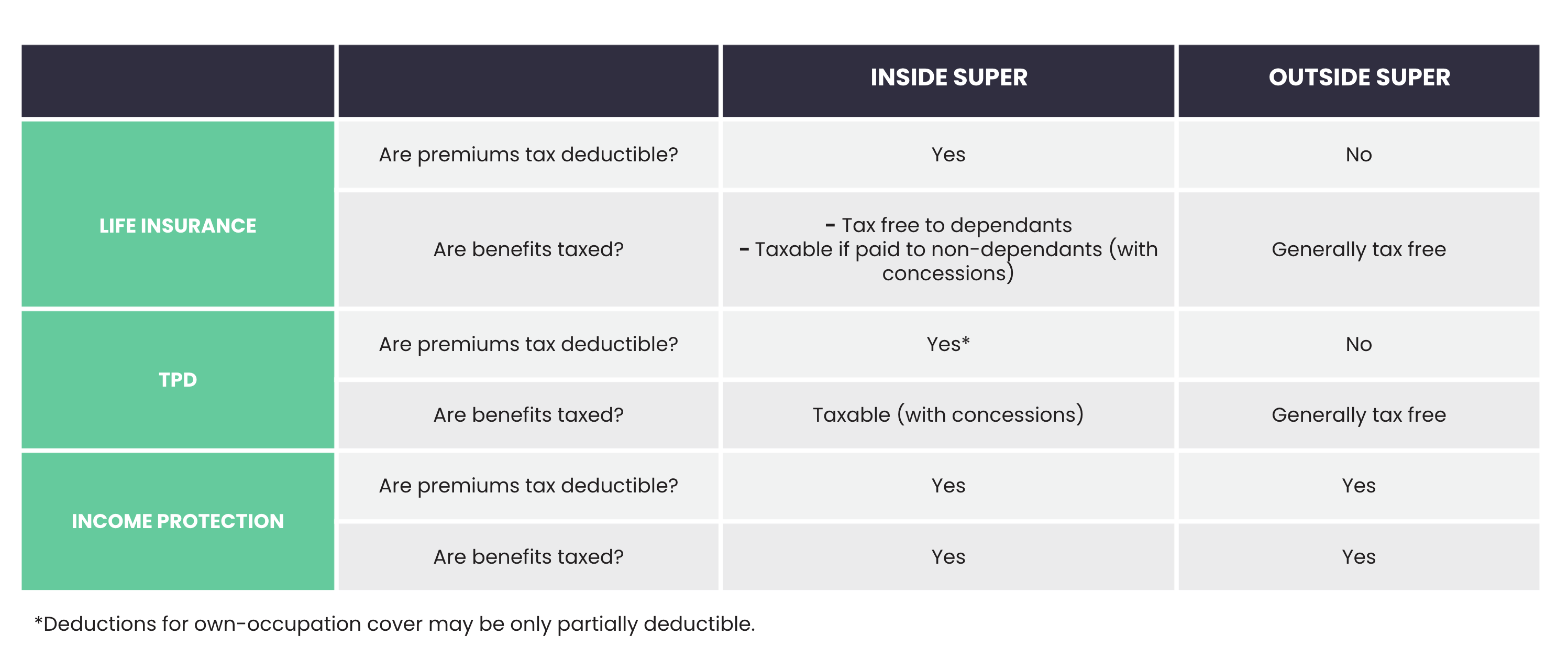

How does the ownership affect the tax-deductibility of premiums and benefits?

Check out the below table for the different policy types and ownership structures:

There are some additional complexities and variations to the above if you are taking out these policies for Business Insurance (Keyman etc).

How to check your insurance through super:

To find out what insurance you have in your super you can:

- contact your super fund directly

- access your super account online

- check your super fund's annual statement which should confirm the current benefits that you have in place

You'll be able to see:

- what type of insurance you have

- how much cover you have

- how much you're paying in premiums for the cover

Your super fund's website will have a Product Disclosure Statement that explains who the insurer is, details of the cover available and conditions to make a claim.

If you have more than one group superannuation fund, you may be paying for duplicate insurance policies. This may reduce your retirement savings more than is necessary and you may not be able to claim on these multiple policies.

It is worth considering whether you need more than one policy or are able to get enough protection through a single account or policy.

Legislative Changes that may affect your insurance inside super

From 1 July 2019, new legislation was introduced to help protect your superannuation balance (Protecting Your Super Legislation).

Whilst the intention of this legislation was good, in some circumstances, it has seen the cancellation of valuable insurance coverage.

If your super fund is deemed to be "inactive" meaning that it has received no contributions for 16 months, your insurance coverage may be cancelled.

This is particularly important for you to consider if:

- You are taking a break from work (maternity/paternity leave)

- You are self-employed and not making regular super contributions

- You have multiple accounts and the fund with your insurance is not receiving regular contributions.

If you have pre-existing medical conditions that would make it more difficult to obtain new insurance, maintaining any benefits is really important.

It is worth using the steps outlined in the section above to check what insurances you have in place and make sure that these are suitable for your needs.

Wrapping Up:

All in all, deciding whether to have your personal insurance inside or outside of superannuation depends a lot on your own personal circumstances as there are pros and cons for both structures.

Whichever structure you choose, it is important to consider the broader implications and not just focus on the immediate benefits when making your final decision.

If you're not sure what to do with your insurances - speak with your adviser or get in touch via the contact page or chat!

Want to stop wasting insurance premiums?

Download my free guide to avoid the 29 most common mistakes people make with their insurance.

Download Here