When it comes to income protection insurance, there are many different types of policies for you to choose from. There is no one size fits all policy and the best policy for you will depend on your specific needs.

This blog post will take a look at what income protection insurance is, why it's important, and how to find the best income protection insurance policy for your needs.

What is income protection insurance and how does it work

Income Protection is also known as salary continuance, is a type of insurance that provides financial assistance to income earners in case they are unable or temporarily impaired.

Income Protection is designed to provide financial support in times of illness or injury where you are unable to work so that all your other needs (mortgage etc) will still be met if needed - without it, this could become difficult.

Unlike the other personal insurance policies (Life Insurance, Total & Permanent Disability, and Trauma Insurance) Income Protection provides you with a regular monthly payment if you are unable to work due to illness or injury.

One of the more common questions is whether income protection pays you if you lose your job (redundancy etc) this is not the case.

To successfully claim on your income protection policy, you need to be unable to work due to sickness or injury for a period of time longer than your waiting period.

I often say the easiest way to think about this is that you must have a Dr's certificate certifying that you are unable to work to be able to claim.

Income Protection can be purchased through your superannuation fund or outside of superannuation paying for these personally (the premiums in both circumstances are tax-deductible but you can only claim premiums you pay personally as a personal tax deduction).

Some of the basic features and benefits of Income Protection Insurance:

There is some key terminology and definitions that relate specifically to income protection policies and these have a beating on income protection premiums:

Waiting Period

The waiting period is the amount of time you need to be unable to work in your usual occupation due to sickness or injury.

You are able to select a waiting period that suits your needs and most income protection policies will have waiting periods from 2 weeks, right through to 2 years.

The shorter the waiting period, the more expensive the cost of these policies.

Statistically, over 50% of people would not be able to survive for longer than 30 days without income however there is a big price difference between a 30 day waiting period and a 90 day waiting period (approximately 50% less) therefore it is a good idea to build up a cash buffer allowing you to rely on your own savings before your income protection policy would begin to pay you.

Things to consider when selecting between waiting periods are how much cash you have on hand, any sick leave you have accrued as well as annual leave and family support.

You may also have workers compensation as part of your employment but one of the big differences between the two is that income protection covers you even if the event that leads to your claim happens outside of work.

Benefit Period

The benefit period as the name suggests is the length of time that the policy will cover you for.

This is usually a set period of time between 24 months (as is common with policies purchase and offered through your super funds) with others continuing to pay you to the age of 70.

In most cases, we suggest a long-term benefit period (to age 65/70) as it is difficult to have the required assets to provide you with enough passive income should you be unable to work for an extended period of time.

When it comes to price, the longer the benefit period you select, the more expensive the premiums are so it is important to consider your personal needs when you are determining the appropriate benefit period for you.

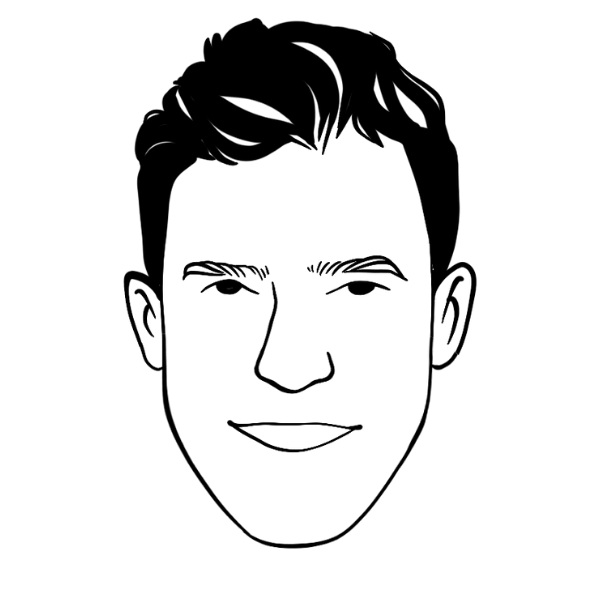

Monthly Benefit

The monthly benefit is the amount of money you will be paid whilst you are unable to work and in receipt of a successful claim.

You can select your own monthly benefit up to a maximum amount which is generally 75% of your income (including super contributions).

Eg. If you are earning $100,000 your maximum monthly benefit would be $6,250 pm ($100,000 x 0.75/12).

Whilst 75% of your income is the maximum you can insure, you can select an amount that is less than this amount should you not require protection from the full amount.

An important thing to note is that the monthly benefit that you select is before tax you will need to pay tax on these monthly benefits and therefore the amount you have to spend will be less.

Using the above example, for a monthly benefit of $6,250 the nett monthly payment would be $4,866 pm. To check your own numbers, here is a link to a quick tax calculator based on the corresponding tax year.

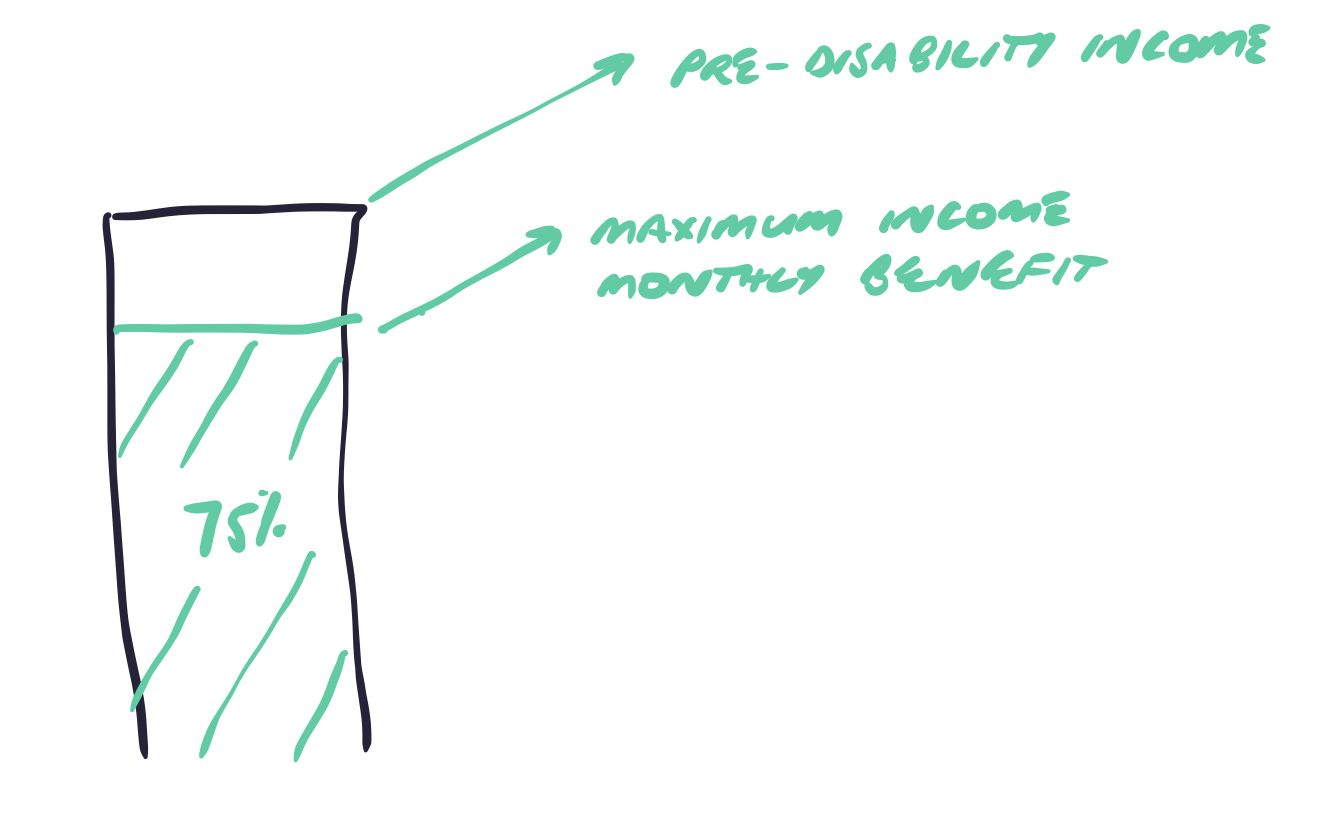

Agreed vs Indemnity:

This section talks about the type of Income Protection policy that you have and specifically relates to the requirements for proving your income to support the monthly benefit that you have selected.

As of the 1st April 2020, APRA stopped the sale of Agreed Value Income Protection policies as one of the first of many changes in the Income Protection space.

If you have purchased or looking to purchase an Income Protection policy after this date, only the Indemnity Contracts are available.

Agreed Value = you prove your income when you apply and do not need to provide any financial evidence when/if you claim on your policy. This type of policy is a good option for those with variable incomes (self-employed, commission-based roles).

Indemnity Contracts = you are required to prove your income when you claim on your policy. This type of contract is generally better suited to those with more stable incomes (employees).

Pre-disability earnings:

pre-disability earnings are the technical term for how much money you were earning when you claim.

The way pre-disability earnings are calculated does vary based on providers so it is worthwhile checking the details of your own policy for the specifics.

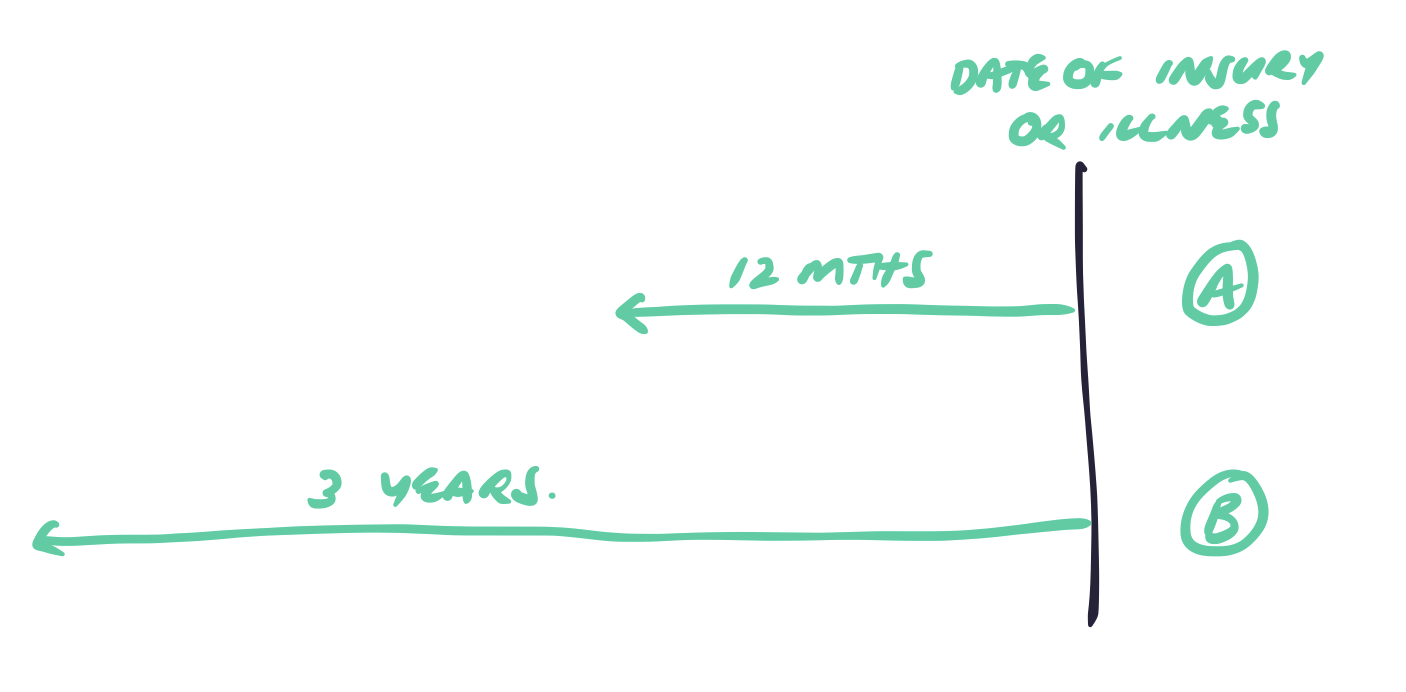

Generally, the insurance company will look at a period of time before your injury or illness to determine this figure.

The variations lie in how long the insurance company will look back to determine what these pre-disability earnings are. Some providers look at the 12 months immediately prior to your claim where others will look back for up to 3 years to determine the highest annual income for you during this period.

It is important to note that this is the figure that will ultimately determine the maximum monthly benefit you will be paid even if it is different from the amount that you are insured for so it is important to understand this.

For more information, check out this video:

Why is income protection insurance important

- Income protection insurance can provide a safety net for your family if you are unable to work due to an illness or injury. You may also be able to access wage replacement benefits, which means that you will receive income from the policy while recovering and being able to return back in full-time employment

- Wage replacement benefits usually cover between 60% - 80% of your gross weekly salary (before tax). This is calculated on what percentage is agreed upon when taking out the policy

The different types of income protection insurance policies available

There are three main ways you can purchase Income Protection in Australia:

Group:

Group insurance is a type of policy that provides protection to a number of people. A group may be defined as:

- Members of the same superannuation fund.

- Employees of the same company.

Group insurance can provide important protection for the individuals in the group, sometimes at a lower cost than they could negotiate themselves.

Group insurance offers value to the employer, who can include it in their benefits program. It also allows superannuation funds to provide competitive insurance coverage for its members.

Group insurance policies do have some disadvantages. As an employee, you have little to no control over your individual coverage. Coverage does not continue or follow the employee if you leave your job (some offer continuation options which would then require you to pay for these policies personally should you leave the employer).

Healthier individuals pay the same premiums as those who are considered to be a higher risk within the group (for example some group policies do not discriminate between smokers and non-smokers).

Direct:

A direct insurer is an insurance company that sells its policies directly to customers without using intermediaries. Direct insurers can charge lower premiums because they don't need to pay commission to intermediaries.

Some examples of direct insurers in Australia are companies such as Noble Oak who have a pretty successful advertising program attracting self-motivated people and assisting them to get insurance without using an adviser or broker.

Retail:

How to choose the best income protection insurance for your needs

When you are considering purchasing income protection cover, it is important to understand the difference between this type of coverage and life insurance. Income protection provides a replacement for your lost wages if you are unable to work due to injury or illness. Life insurance covers your family's financial security by replacing some of their income in the event that one spouse dies.

Income Protection can be more expensive than traditional forms of life insurance because it pays out over time as opposed to all at once with death benefits.

Most policies will pay out around 60% - 70% of an individual's salary while they are medically incapable of working, up until age 65 when social safety nets take over. The best way to determine how much income protection you need is by calculating how long you would

Who should get this type of insurance

If you look at your own situation and determine your lifestyle be affected should your income suddenly stop then Income Protection is one option you should consider?

This problem could be one you are faced with whether you are single, a couple without kids, or a family.

As a family unit, it is very common that you would be able to survive on one of your incomes with many of us going through this at some stage (starting a family being the primary time that this occurs).

With proper questioning and someone to challenge you, a tailored solution that fits your needs is attainable.

Who offers this type of coverage and how much does it cost me monthly

Most super funds offer Income Protection insurance and even if they do not this does not mean you cannot apply for a policy and have the premiums deducted from your nominated superannuation account.

If you are looking to compare Income Protection insurance policies, my suggestion is always to go back to your existing super fund and grab an insurance quote as the first step.

Another way to compare income protection is to use some of the online tools available. One of those resources is a company called Lifebroker. Lifebroker will not assist you with the cover you may need however will provide you with a quote comparing 5 different insurance companies. They are owned by TAL so keep this in mind when looking at the quotes that come back.

If you want some help comparing the different policies available and advice on the best structure for these policies, going directly to your super fund or Lifebroker will allow for general advice only.

If you are after personal advice, it would be best to get in contact with a Financial Planner who specialises in insurance (like us 😀).

As financial planners, we need to be an Authorised representatives to provide advice that is tailored to your situation and needs. We can help determine the level of cover you need based on your personal situation and then do the legwork to compare what is available through your super with the policies available across the market with different insurers.

The other benefit of using a financial adviser is that should you ever need to make a claim on your policy, they will be there to help facilitate this claim. This can be beneficial as they are firstly not emotionally impacted by the claim and should have experienced facilitating these claims before making this process as easy as it can be.

Why do you need it, even if you don't have kids or a mortgage

For those of you without kids and without a mortgage, it is still important to consider income protection insurance because there's no way to predict what life may throw at us in the future!

Even without kids and a mortgage, how long could you last if you were unable to work due to illness or injury?

The average person would be able to live off their savings for less than six months. When bills and rent start piling up, it's not long until the pressure becomes too much. That is where income protection insurance comes in!

Income protection insures your earnings and provides a monthly benefit so that your family can have some stability while you're out of work recovering from an illness or injury.

Whilst the amount of income you may require to protect may be different based on your personal circumstances, it is very rare that many of us would be able to last indefinitely without income from our personal exertion. If that is the case for you, congratulations but I would suggest you are probably not reading articles like this one.

What are the benefits of getting an income protection policy (including tax breaks)

Income Protection premiums are tax-deductible in Australia, and the income protection policy reduces your taxable income. This means that you have less of your salary to pay tax on each year because it's offset by the premiums paid.

Income Protection premiums paid from superannuation also receive the tax benefits however the tax deduction is passed on via your super fund and can not be claimed in your personal tax return. Only premiums paid by you personally can be included as a deduction in your personal return.

Like all insurance policies, you hope to never need to use the cover therefore peace of mind is the major benefit of Income Protection. Knowing that you have a backup plan should something happen that precludes you from working.

One of the major fears I hear about insurance, in general, is around insurance companies not paying claims. ASIC did a study into this and irrespective of the channel by which you purchased these insurance policies here in Australia (group, direct or retail) over 90% of all claims were successfully paid.

This fear around insurance companies not paying is, therefore, a big myth that is not the reality of what actually happens in the market.

Is there a discount if I pay annually instead of monthly

When you are considering the frequency you are looking to pay for your income protection insurance, it's important that you consider all the options. The best option for most people is to have their monthly payments deducted from their bank account automatically each month.

But there are some advantages to paying annually instead of monthly - if you're not a fan of having regular payments taken out regularly and would rather wait until the end of the year before finally making a lump sum payment then this might be just what you need.

Generally, there is about a 5% discount for paying for these premiums annually rather than monthly.

If you pay for the Income Protection premiums from your super fund, if it is the super fund's insurance policy itself then they will have different frequencies (some weekly, monthly, or annually). Alternatively, if you pay for these premiums via a premium rollover, this will generally be an annual payment.

What are some other types of coverage I should consider for my personal needs, like disability or critical illness?

When assessing your overall insurance needs, Income Protection is one of the insurance products that I suggest for anyone who relies on their income to support their lifestyle.

The other personal insurances that are available are Life Insurance, Total and Permanent Disability (TPD), and Trauma Insurance. Another consideration is any Private Health Insurance that you have as well. All of these policies for part of this defensive strategy and I like to look at the amount of money you put towards this defensive strategy as a pool of funds.

The way you deploy these funds will be based on your personal circumstances and a good strategy will be fluid enabling you to make adjustments as your needs change over time.

Frequently Asked Questions

How much is income protection monthly?

The price of income protection will vary based on your own financial situation or needs.

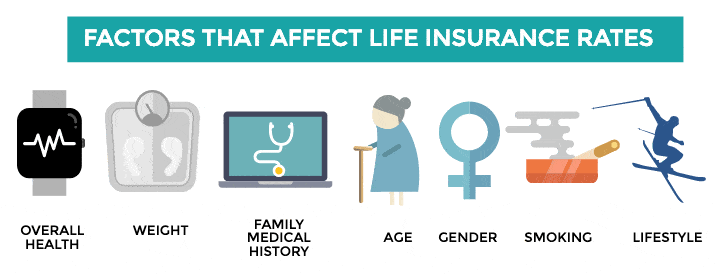

Some of the factors that the insurance companies take into account when determining price are:

- You age

- Your occupation

- Your sex

- Are you a smoker or a non-smoker

- How long is the waiting period

- How long is the benefit period

- What is your income

- Do you do any hazardous pastimes

- Do you have any pre-existing conditions?

- Are you selecting stepped or level premiums?

Can you have 2 income protection policies?

Yes, you can have multiple Income Protection policies however the total monthly benefit cannot exceed the maximum benefit allowed based on your pre-disability income.

You must also tell the insurance company of any other income protection policies you have when you apply for a new policy.

Can I buy income protection insurance directly?

Yes, there are some direct insurance companies that offer income protection. One of these companies is NobleOak who claims to save you 20% by going directly to them and cutting out the middle man (advisers). Think of them as the "Koala mattresses" of the insurance world.

You can check out this video I recorded for more information about Noble Oak and this claim of saving 20%

Does income protection cover medical expenses?

Income Protection is not prescriptive with regards to how you spend the benefits of the policy. How you spend these funds is completely up to you. If you were to claim on the policy, it is likely that you would use some of these proceeds to pay for medical expenses

What is the best income protection insurance in Australia?

There is no "best" income protection policy as this is highly personal so it is best to do your research. Look for a reputable company with a good claims record and if you are stuck reach out for help from a trusted adviser.

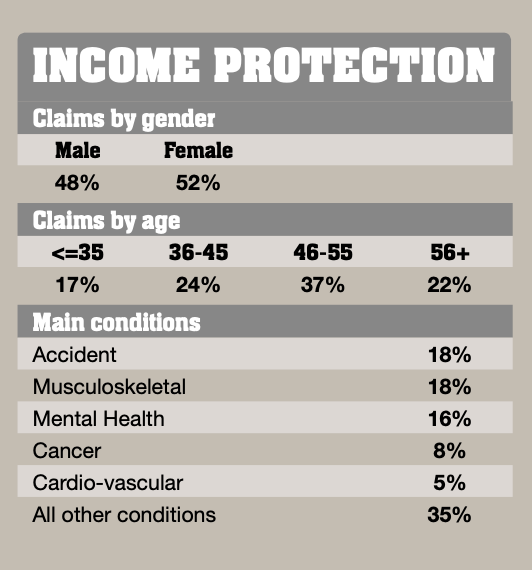

What are the most common claims for Income Protection here in Australia?

The most common claims for Income Protection in Australia come from Accidents, Mental Health and muscular-skeletal claims (think back and necks).

Conclusion

Income protection is not just for those who have kids and is more suited to anyone that relies on the income they earn from work to support their lifestyle.

It can be a good defensive strategy as you accumulate wealth, so it’s important to think about how much insurance you really need in your life.

That's why we created this free quiz which will help you figure out what type of policy would best suit your needs, based on some basic information. Click here to give it a crack today!

Stop wasting money on premiums!

Download my free guide to avoid the 29 most common mistakes people make with their insurance.

Download Here