Income Protection is one of the four personal insurances that I can help you with. My goal with this article and the supporting video is to condense everything I know about Income Protection and share it with you.

Whether you already have an Income Protection plan in place, or you are asking yourself the question "Do I need Income Protection?" The information here will provide you with everything you need to make sure the Income Protection option you select, is perfect for you.

Income Protection Insurance Basics

You may have heard people say "Income Protection is important as your ability to earn an income is your biggest asset.

What is meant by this, is if you were to add up the income that you will earn for the rest of your working life between now and retirement, is a massive number.

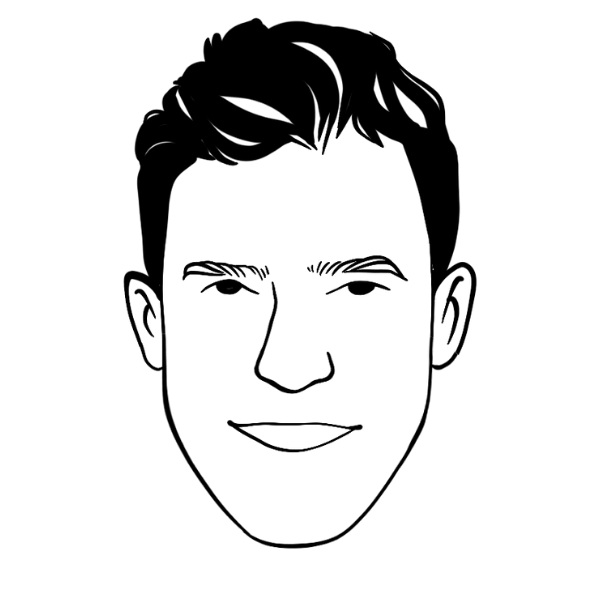

I did the calculation via the Lifetime Earning Calculator (click here to try it for yourself).

In this example, I have assumed the following:

- Age - 40

- Current Income - $100,000 pa

- Retirement Age - 65

- Annual Increase - 2%

As you can see from the above example, the future earnings are $3.2 Million dollars!

Income Protection provides a safety net to protect these future earnings.

Unlike some of the other insurances, there are no specific listed injuries or illnesses that need to happen for you to be able to make a claim. The easiest way to think about this is Income Protection will cover you for anything you would be able to get a Dr's certificate for.

One of the most common questions I get asked is about redundancy. Redundancy is not covered by Income Protection. There are a few policies in the market that do cover redundancy, but if you take the time to look into these policies, they are not worth the paper they are written on. I have done a detailed video explaining this, if you are interested, check it out here.

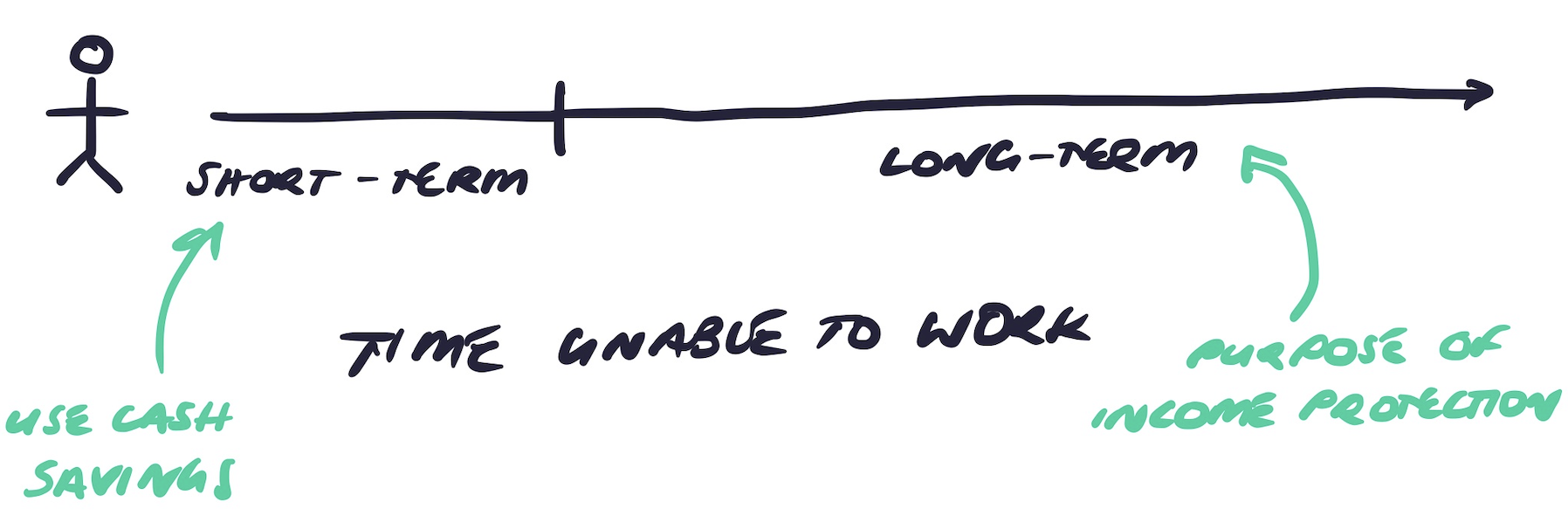

Some policies will have temporary features you could exercise should you lose your job or be made redundant, but, in my opinion, covering short-term income gaps is not what Income Protection is designed to do.

To protect yourself from this, my suggestion is to work on having a cash buffer.

The benefits you receive from your Income Protection policy are taxable & the premiums are eligible for a tax deduction. I'll provide some more details of this later in the article.

Key Features of Income ProtectionThere are three key elements of an income protection policy

- Monthly Benefit

- Waiting Period

- Benefit Period

Monthly Benefit:

The monthly benefit is how much you would be paid should you need to claim on your policy. An important thing to note is that the monthly benefit is before tax and if you were to claim, the income received from your policy is taxable.

If you would like to work out how much you would receive after-tax, check out this link. Enter in the details of your monthly benefit and this will calculate the tax payable and the nett amount that you can expect to receive should you need to claim.

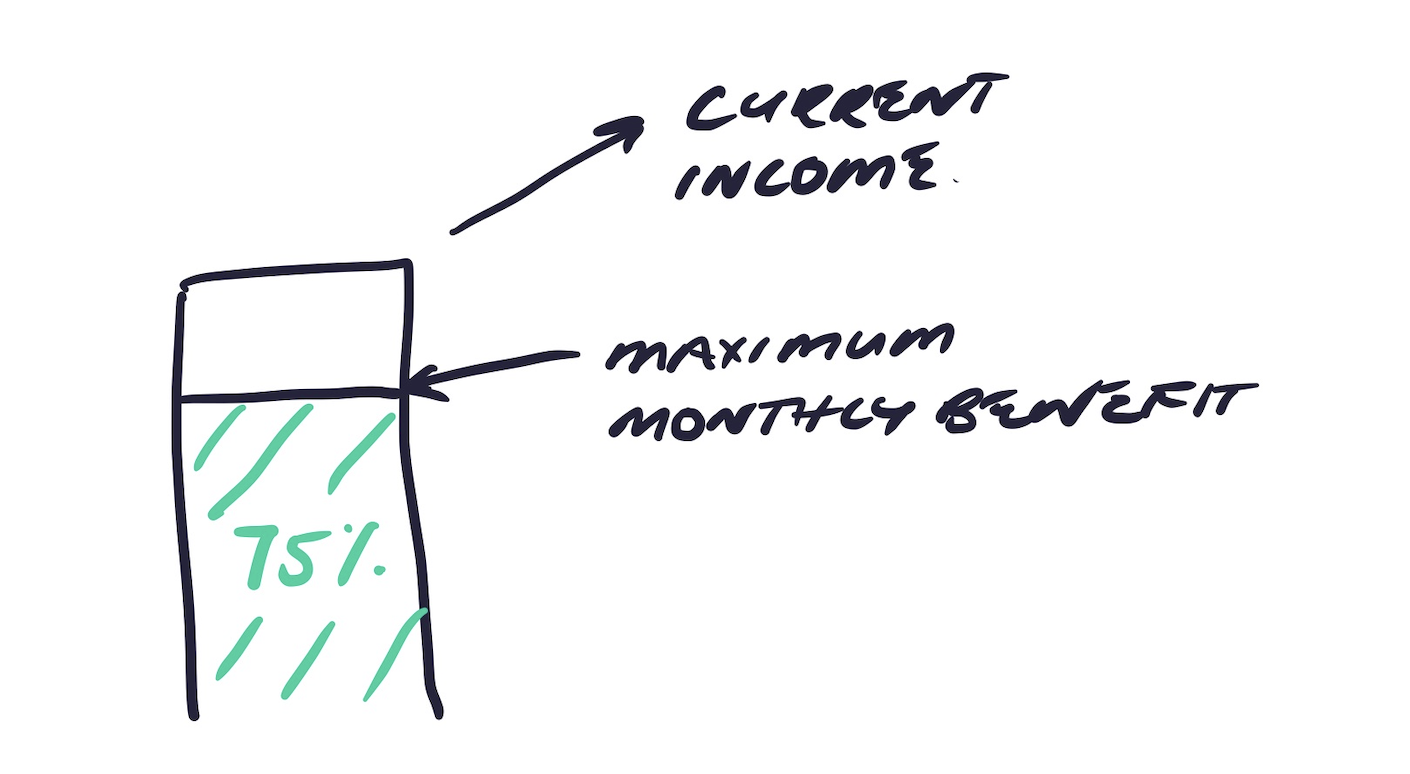

The maximum monthly benefit varies a little bit depending on the provider but generally speaking the maximum you can insure is 75% of your salary. The reason for this is that there needs to be some incentive for you to go back to work.

In addition to this, one thing I always consider is adding super contributions to your monthly benefit. What this does, is in addition to the regular monthly income, these additional payments would protect your future super contributions

This is important because if you were to be unable to ever work again and you don't include this feature, your super balance will be the same as it is now + the earnings on these funds over time. This can make a massive difference to you and life in the future.

Waiting Period:

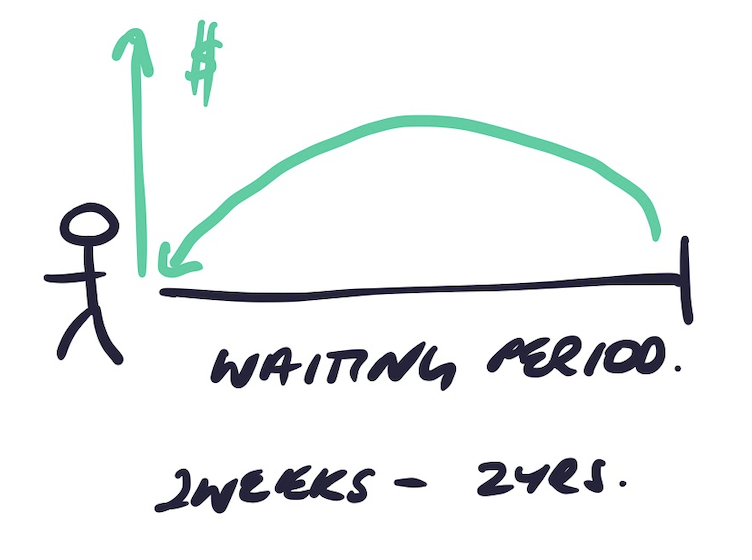

The next key feature is the waiting period, this is how long you need to be off work before you are paid by the insurer. The waiting period is something you can choose and can be anywhere from 2 weeks → to 2 years.

The waiting period has a massive impact on price, with the shorter the waiting period, the more expensive the premium. To give you an idea, the price difference between a 30 and 90 days waiting period is about 40%.

Another important thing to note about waiting periods is the first payment is not made until a month after the waiting period has been met, this means on a 30 day waiting period, the first payments not until the 60-day mark and a 90 day waiting period means you won't receive the first payment until 120 days.

When you are considering the most appropriate waiting period for you, make sure you have enough sick leave, holiday pay or cash to satisfy whatever choice you make.

Benefit Period:

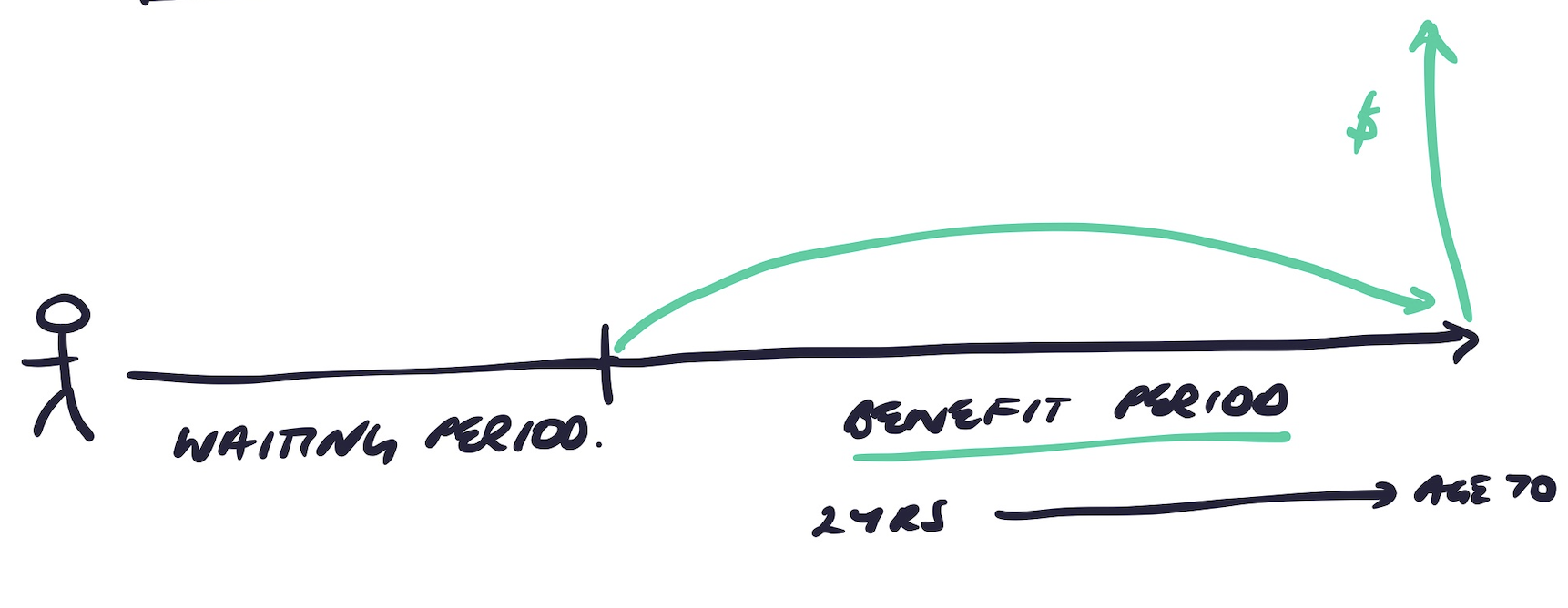

The benefit period as the name suggests is how long the insurance company will continue to pay you if you continue to be unable to work. Benefit Periods can be anything from 2 years, through to age 70 with some providers. You again can choose the option that best suits you. The longer the benefit period, the more expensive the premium.

After the benefit period ends, payments from the insurance company will stop.

Many of the basic Income Protection policies provided to you via your super fund will offer a default benefit period of 2 years. It would be worth checking with your policy to see what benefit period you have currently.

Contract Types:

When it comes to premium types, there are two:

- Agreed Value;

- Indemnity Contracts

The major difference between the two is when you prove what your income is (with supporting documents). These supporting documents are different depending on whether you are an employee or self-employed.

Agreed Value policies, are when you prove what you are earning when you apply for your insurance where Indemnity Contracts require you to prove your income when you claim.

Policies will vary with their rules about how they calculate your pre-disability income so make sure you check this with your provider (this is relevant if you have an indemnity contract).

If you already have Income Protection I'd suggest double-checking which type of benefit you have. If you are looking at income protection now, there is only one way with Agreed Value policies being stopped as of 31 March 2020.

For more information on this, I wrote a detailed article on the changes which you can check out here.

Examples of Common Claims

Unlike some of the other insurances such as Trauma Insurance, there are no listed injuries and illnesses that you are required to satisfy for a successful claim when it comes to income protection.

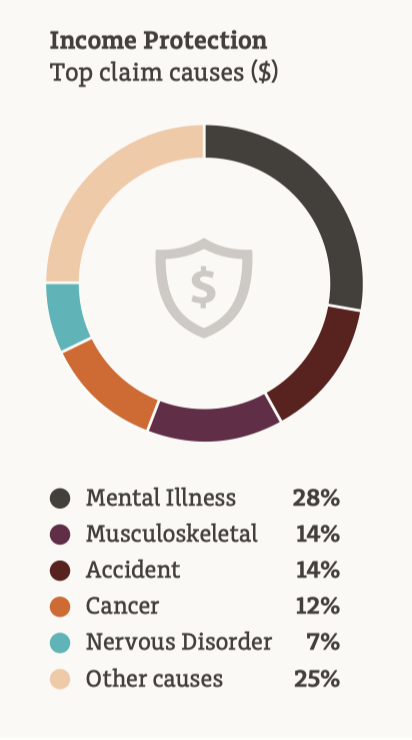

To give you some insight into things you can claim on, I wanted to share the claims statistics from one of the major insurers. This will give you an indication as to the actual figures as well as the most common claims.

The above figures are from MLC for 2018 where they paid $192.8 Million dollars in Income Protection claims for the year. Whilst these numbers are from one insurance company, they are reflective of the industry in general.

From the above diagram, you can see that approximately 70% of all claims came from the following four broad categories:

- Mental Health (anxiety, stress, depression etc)

- Musculoskeletal (think backs and necks)

- Accident; &

- Cancer

As I mentioned earlier, the easiest way to think of Income Protection is that you would be able to claim on your policy if you have a Dr's certificate stating that you cannot work. This Dr's certificate will need to see you unable to work for longer than your waiting period for you to be able to claim the benefits.

Depending on your policy and how this has been set up, there are some extra features you can claim on if your policy is owned and paid for personally (ie not through super). The most common extra that I see is the specific injury benefit which pays a set amount irrespective of whether you can work or not.

The reason I am sharing this particular benefit with you is I've personally had 3 of these from my younger days when I must have had brittle bones! And to give you an idea, I've helped 2 of my clients with these benefits in the last month alone.

How Much Does Income Protection Cost?

Given there are so many factors that go into determining the price, it is difficult to give you much of a guide here.

These factors include:

- Age (the older we are the more expensive the premiums)

- Occupation (the riskier your occupation, the more you pay)

- Lifestyle factors (smoking, pastimes etc)

- Gender (different premium rates for males and females)

- Waiting & Benefit Periods (depending on your selected options)

- And of course how much you earn.

To get some quotes for this, you can either go back to your super fund as most of these have online premium calculators or you could try an online service like Lifebroker which will compare the pricing from about 5 different insurers. NB Lifebroker is owned by TAL (an insurance company). Being aware of this may give you some context if the TAL policies are recommended highly.

Stepped or Level Premiums:

The other thing that affects the price is whether you have stepped or level premiums. I have recorded a video explaining stepped and level premiums in detail which you can check out here.

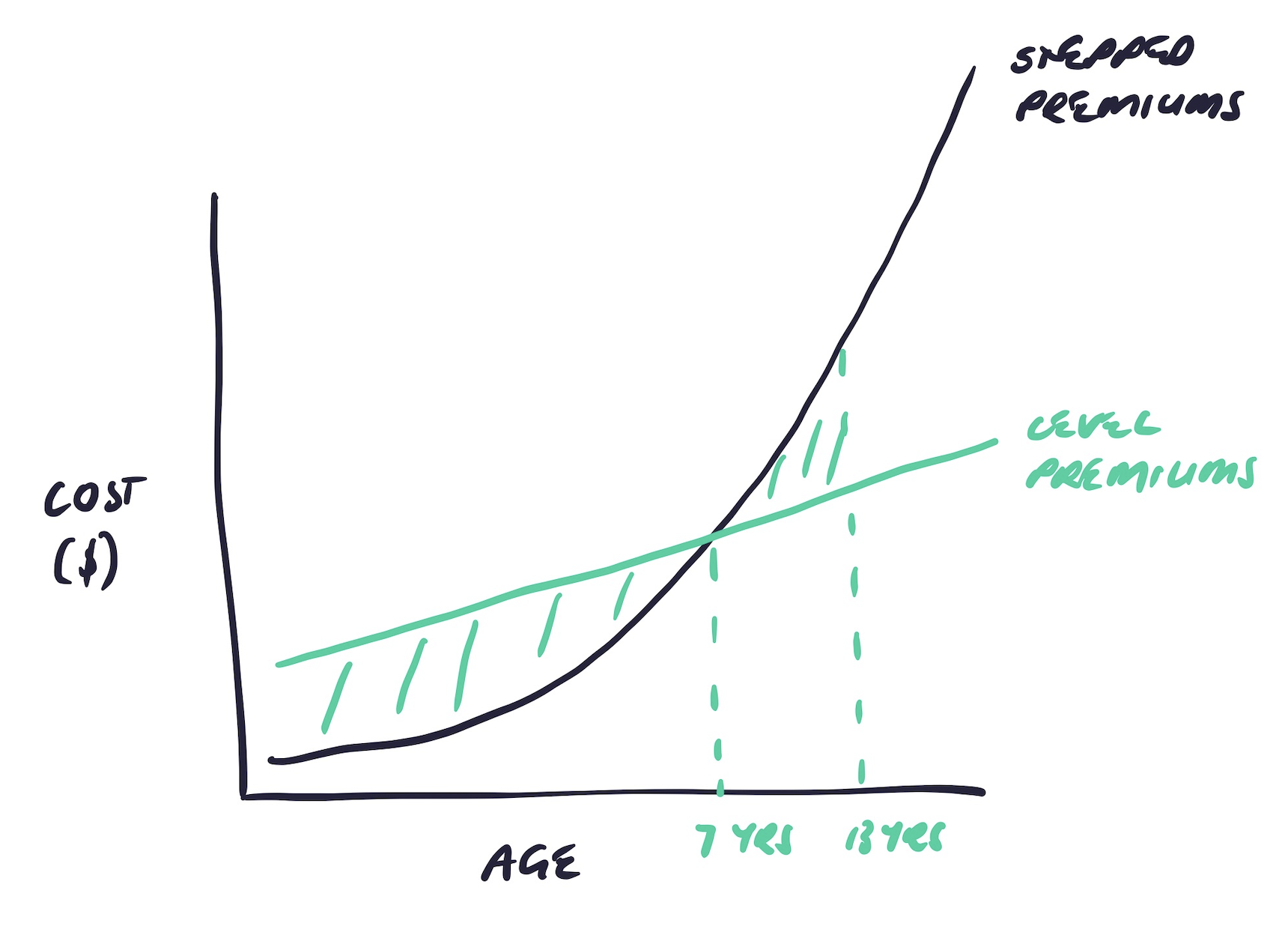

Basically, Stepped Premiums start out cheaper and increase in cost as we get older. Level Premiums start out more expensive but do not have the aged-based increase. If you have Level Premiums in place for more than 13 years, you will save significant amounts in total premiums.

I do believe Income Protection for the right people is one of the covers that you can consider level premiums for but again, this is case by case.

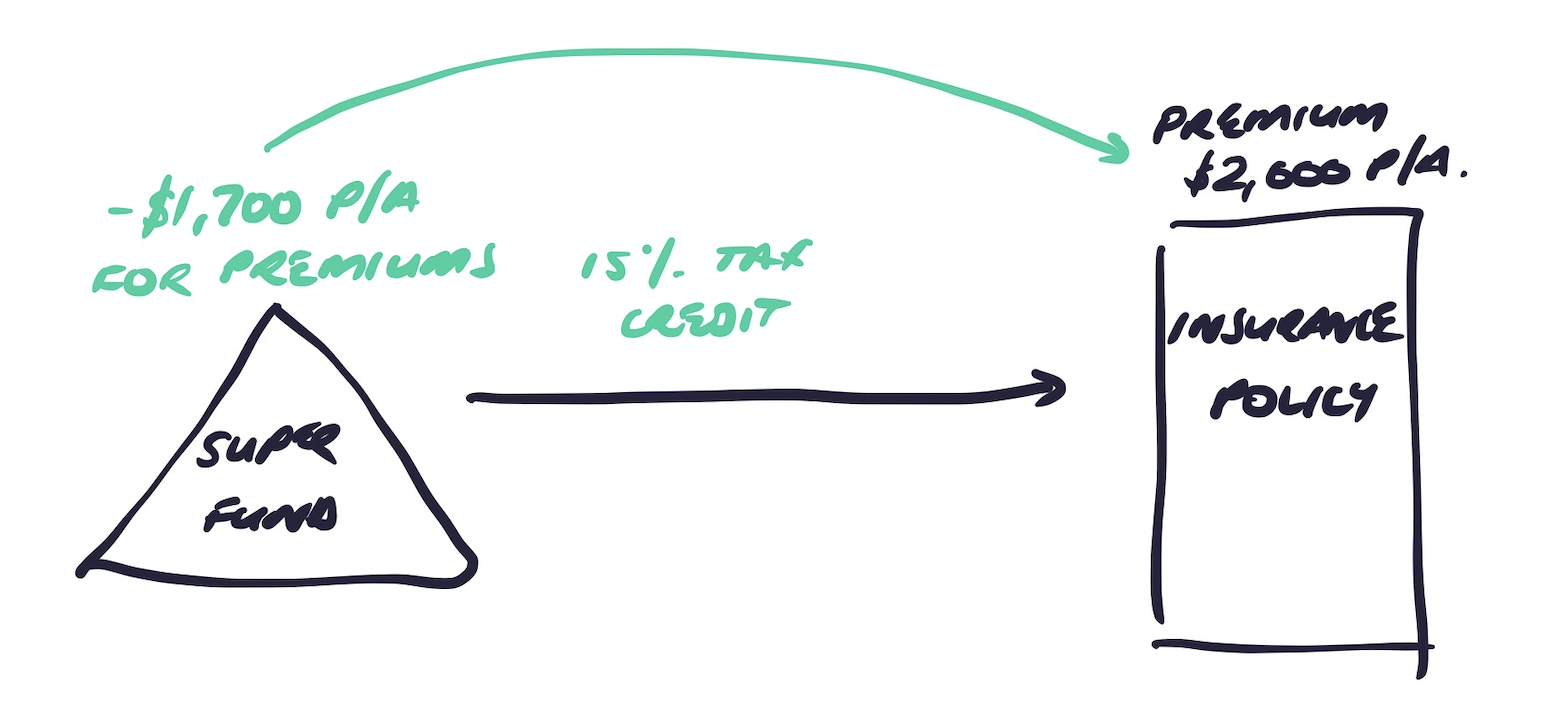

As mentioned earlier, income protection premiums are tax-deductible the reason for this is that the benefits that you receive are taxable.. You can claim this personally if you pay for these from your bank account or the tax credit is passed on if you pay this via your super

To explain what I mean by this, let's assume your income protection premium was $2,000 pa, if paid from super, this receives a tax credit of 15% which means the nett premium is $1,700 pa. If you pay for your premiums via super, you cannot claim anything in your personal tax return.

Super or Non-Super?

There are pros and cons to both setups. I am going to keep these differences simple so as not to confuse them. Income Protection policies owned and paid for outside of super generally have more of the extras included in the policy, for example, the specific injury benefit I mentioned earlier in the video. This would not be covered in a policy paid via super.

The reason for this is when the policy is owned and paid for via super, to receive the benefits, you must satisfy the rules of the super world to get paid. This is known technically as a condition of release.

The reason I see that a lot of people decide to have income protection through super is cash flow. We don't tend to treat the premiums paid from super in the same way as if we needed to pay for these from our cash flow.

If you elect to pay for your insurance premiums from super, whilst you won't feel the initial cash flow strain, it does affect your long term wealth.

Here's an example, let's say you were 40, had a current super balance of $200k and were earning $100,000 pa. Let's also assume your Income Protection premiums were $3,000 pa and you decided to pay for these from super.

The balance you have in super at retirement would be about $85,000 less as a result of these premiums.

*Source - ASIC MoneySmart Calculator.

There are strategies you can do to negate this, but for most people, paying for premiums from super without thinking about the consequences is only stealing from future you to pay for the current you! If you are tossing up between the two, it is important to consider these long-term impacts and not just the immediate cash flow benefits.

Conclusion

From this comprehensive guide, there is a lot that makes up an income protection policy and this is without even starting to compare different providers and products.

I hope that this helps you when you are considering your own Income Protection needs. If you have any questions, let me know!

Stop wasting money on premiums!

Download my free guide to avoid the 29 most common mistakes people make with their insurance.

Download Here