Are your premiums getting more expensive each year? The reason for this is statistically, the older we get, the more likely we are to claim on the insurance we have.

With the Reserve Bank of Australia recently cutting their rates to record lows, today, I am going to show you how these rate cuts can save you money on your insurance.

In this article, I am going to share:

- How to use the interest rate cuts for good

- How to safely reduce your cover levels without sacrificing your needs

- How to maintain the minimum levels of cover at all times

How can you use the interest rate cut for good?

With the Reserve Bank cutting interest rates to record lows, for most of us with a mortgage, this means the amount of money we are required to pay to the bank are lower each month.

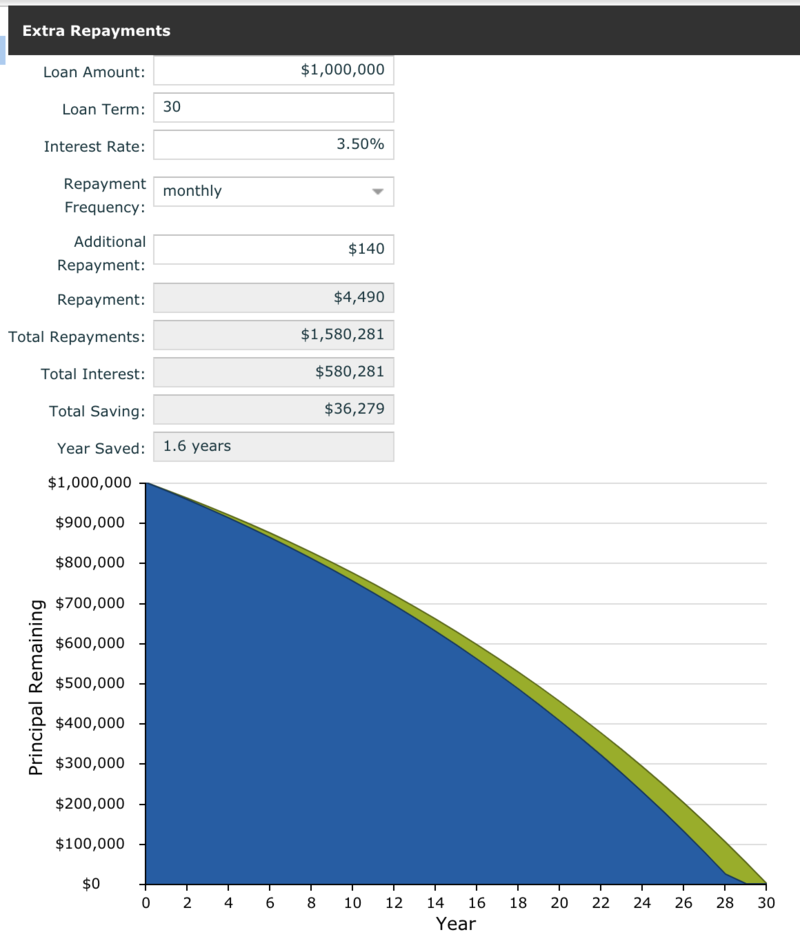

If you have a $500,000 mortgage, you will save about $70 per month, if your mortgage is $1,000,000 you will save approximately $140 per month.

A friend of mine Chris Bates posted an article on LinkedIn recently on how to use this interest rate for good. In Chris's example, if you were to keep your mortgage repayments at the same amount as before the cut, this interest rate cut will save you about 18 months on your loan.

Instead of just blowing the extra cash, this will allow you to get ahead without really feeling it.

How does this apply to insurance?

I bang on a lot about having a purpose-linked insurance package. What I mean by this, is whilst the cover you need is different from other people, I believe that the principles remain the same.

If you don't know the reason WHY you have the amount of insurance, there is no way of revisiting these cover levels. This means that the only thing you compare when looking at each year is the price! How much has your insurance premium gone up compared to last year?

I have recorded a video here where you can check out the principles I use to calculate each of four personal insurances.

Now that you have been making extra repayments to your loan, as the loan reduces, so too does your need for insurance.

By understanding the reason why you have the insurance cover you do, you can safely adjust your insurance levels feeling comfortable that you (or your family) will not be left short if anything happens to you.

Don't want to do the calculation yourself, I have built a calculator that will do this for you (check it out here).

How do you know when to adjust your insurance levels?

My goal is to make sure you have the minimum level of insurance at all times. I have been doing this for a long time, and I have never met anyone who loves spending money on insurance.

I can show you as many claim statistics as I could but there is still more chance that you will never need your insurance than there is the chance that you will need to claim on this.

For that reason, I believe you should spend your money on your premiums accordingly.

If you are doing this yourself, set a reminder in your calendar every 12 months (when your super statements are sent out), to sit down and update your principle numbers and then adjust your coverage levels accordingly.

For my clients, every year, 6 weeks before review time, I get in touch to get an update on what has changed. I then revisit each of the principles and make sure we adjust the cover levels accordingly.

Some years, there is not a great deal that has changed, which is fine! But at least we know we are not wasting a single dollar on insurance we don't need. That is the key.

Bonus tip

If you are disciplined with this, as you reduce the amount of money you are spending on insurance, you can add this to your mortgage repayments. This means from a cash flow perspective, you are exactly the same but you will again speed up the time it takes to be debt-free!

Conclusion

I know that money spent on insurance often feels like wasted money. If you follow the tips above, not only will you know exactly WHY you have the insurance that you do but also have a simple framework for reviewing this each year!

What tips do you have for saving money on your insurance? Let me know in the comments.

Stop wasting money on premiums!

Download my free guide to avoid the 29 most common mistakes people make with their insurance.

Download Here